The DJIA retreated from its year-to-date closing high as crude futures sold off

The

Dow Jones Industrial Average (DJIA) took a brief trek higher this morning, but eventually succumbed to tumbling oil prices. Additionally,

relatively hawkish comments from Boston Fed President Eric Rosengren -- which ran counter to

last week's speech from Fed Chair Janet Yellen -- and an uninspiring report on factory activity only fanned the bearish flames, offsetting

gains by healthcare stocks. At the close, the Dow had pulled back from its

year-to-date closing high, while the broader

S&P 500 Index (SPX) was pressured by a sell-off in industrial stocks.

Continue reading for more on today's market, including:

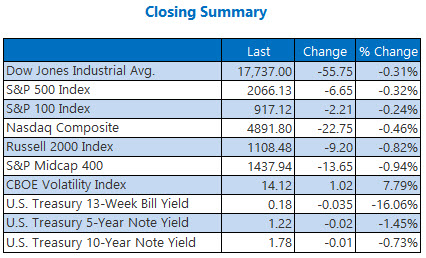

The Dow Jones Industrial Average (DJIA - 17,737.00) explored a nearly 96-point range, before settling down 55.8 points, or 0.3%. Nike Inc's (NYSE:NKE) 2.6% drop paced the 18 Dow decliners, while Pfizer Inc.'s (NYSE:PFE) 2.3% jump paced the 11 advancers. Home Depot Inc (NYSE:HD) finished flat.

The S&P 500 Index (SPX - 2,066.13) edged higher at the open, but eventually closed with a 6.7-point, or 0.3%, loss. The Nasdaq Composite (COMP - 4,891.80) fared the worst of its peers, shedding 22.8 points, or 0.5%.

The CBOE Volatility Index (VIX - 14.12) added 1 point, or 7.8%, but ran out of steam near its 10-day moving average.

5 Items on Our Radar Today:

-

According to the Commerce Department, factory orders fell 1.7% in February -- the 14th drop in the past 19 months -- while January's increase was downwardly revised to 1.2% from 1.6%. (Reuters)

- The Department of Justice (DOJ) has sued ValueAct Capital Management for failing to disclose its stake in Baker Hughes Incorporated (NYSE:BHI), amid BHI's proposed takeover by Halliburton Company (NYSE:HAL). Considering the hedge fund also owns a stake in HAL, this is seen as a violation of pre-merger notification requirements. (Fortune)

- Alaska Air Group, Inc. (NYSE:ALK) has agreed to buy this sector peer, creating the fifth-largest airline in the U.S.

- Record attendance for Wrestlemania 32 sent World Wrestling Entertainment, Inc. (NYSE:WWE) popping -- and options volume soaring.

- 3 biotechs on the move.

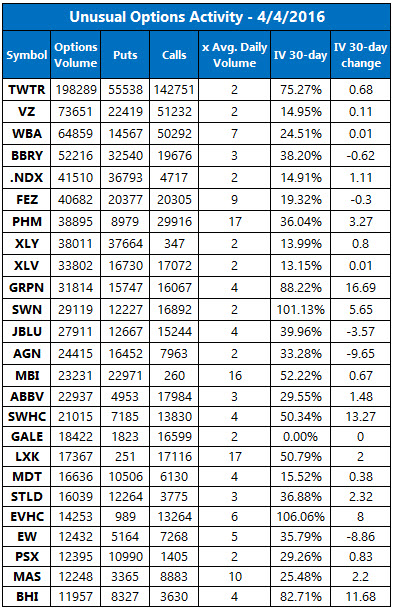

Data courtesy of Trade-Alert

Commodities:

Crude futures fell today, amid skepticism that major global oil producers will agree to freeze output at an upcoming April 17 meeting. By the close, crude for May delivery was off $1.09, or 3%, at $35.70 per barrel -- its lowest close since March 3.

Gold edged lower, after Rosengren's statement stoked uncertainty over the Fed's monetary policy timeline. At session's end, gold for June delivery was down $4.20, or 0.3%, at $1,219.30 per ounce.

Stay on top of overnight news & big morning movers. Sign up now for Schaeffer's Opening View