The DJIA followed oil lower, but still managed a positive finish for the week

The

Dow Jones Industrial Average (DJIA) enjoyed an early pop, but stocks spent most of the session slowly sinking, echoing crude oil prices. Traders considered

a strong round of economic reports, but the latest batch of inflation data fueled expectations for a Fed rate hike in 2016, taking some wind out of the bulls' sails.

Continue reading for more on today's market, including:

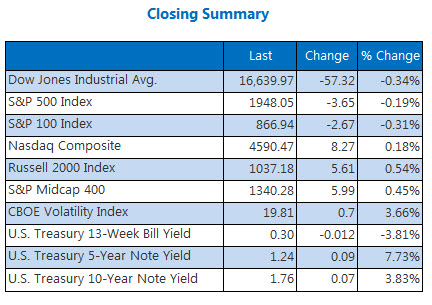

The Dow Jones Industrial Average (DJIA - 16,639.97) fell 57.3 points, or 0.3%. DuPont (NYSE:DD) led 10 of the 30 blue chips higher with a 1.8% gain. The Coca-Cola Co (NYSE:KO) was the leading laggard, giving up 2.3%. For the week, the DJIA gained 1.5%.

The S&P 500 Index (SPX - 1,948.05) shed just 3.7 points, or 0.2%, ending the week up 1.6%, while the Nasdaq Composite (COMP - 4,590.47) managed a win for the day, adding 8.3 points, or 0.2%, to bring its weekly gain to 1.9%.

The CBOE Volatility Index (VIX - 19.81) climbed 0.7 point, or 3.7%, but ended the week 3.5% lower.

5 Items on Our Radar Today:

-

New Jersey Governor Chris Christie, who dropped out of the presidential race after a poor showing in New Hampshire earlier this month,

announced his support of Donald Trump for the Republican candidacy. Christie argued that he believes Trump to have the best chance of beating Democratic front-runner Hillary Clinton in November's election. (

Bloomberg)

-

The January U.S. trade deficit for goods hit its largest gap in seven months, as the dollar gained strength against global currencies. Imports and exports both fell for the month, with food and beverage exports marking the biggest decline. (MarketWatch)

-

-

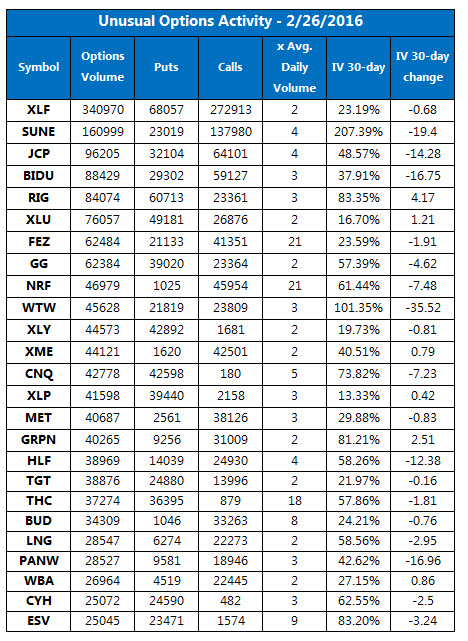

- Why Baidu Inc (ADR) (NASDAQ:BIDU) option bears might be kicking rocks.

Data courtesy of Trade-Alert

Commodities:

Crude futures began the day higher, but ended a choppy session with a loss, despite supply disruptions in Nigeria and Iraq and a weekly drop in operating rigs in the U.S. Crude for April delivery finished the day down 29 cents, or 0.9%, at $32.78 a barrel. For the week, crude added 3.2%.

Growing strength in the dollar weighed on the price of gold. Gold futures for April dropped $18.40, or 1.5%, to close at $1,220.40 an ounce, while the malleable metal shed 0.8% this week.