The DJIA faces additional headwinds from an ongoing sell-off in China's stock markets

An ongoing downturn in Chinese stocks is once again weighing on

Dow Jones Industrial Average (DJIA) futures, just a day after the blue-chip index

suffered its worst start to the year since 2008. At home, with little to note on the calendar today (save for December auto sales), traders are turning their attention to the White House, where President Obama is expected to announce

expanded gun control measures. On the commodity front, crude oil remains in focus, with February-dated futures up 0.4% to $36.91 per barrel amid a

tense situation between Saudi Arabia and Iran.

Continue reading for more on today's market, including:

Futures on the Dow Jones Industrial Average (DJIA) are about 18 points below fair value.

5 Things You Need to Know Today

- A cash injection from the People's Bank of China (PBOC) failed to stop the bleeding on mainland markets.

- The Chicago Board Options Exchange (CBOE) saw 775,278 call contracts traded on Monday, compared to 618,316 put contracts. The resultant single-session equity put/call ratio jumped to 0.80, while the 21-day moving average edged up to 0.72.

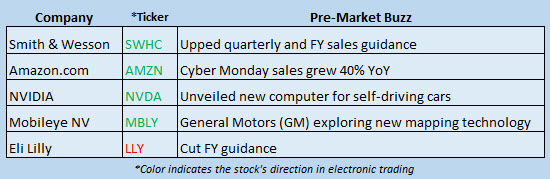

- Eli Lilly and Co (NYSE:LLY) -- fresh off a new partnership with Halozyme Therapeutics, Inc. (NASDAQ:HALO) -- downwardly revised its 2015 earnings estimate, and offered up 2016 profit and revenue forecasts that fell short of analyst estimates. LLY is trading 0.9% lower pre-market.

- Following in the footsteps of Facebook Inc (NASDAQ:FB), Netflix, Inc. (NASDAQ:NFLX) executives told Reuters the company plans to expand into India, with a formal announcement possible at this week's Consumer Electronics Show (CES). Ahead of the bell, NFLX is up 1.1%.

- With automakers attempting to push into the autonomous car market, NVIDIA Corporation (NASDAQ:NVDA) unveiled at CES a new super-computer designed specifically for self-driving vehicles, called the Drive PX 2. The chipmaker added that Volvo will be the first company to adopt the technology. Ahead of the open, NVDA is 1.8% higher.

Earnings and Economic Data

Automakers will be in focus today, with December auto sales slated for release. Sonic Corp (SONC) will step up to the earnings plate. To see what else is coming up on this week's agenda, click here.