XLF has surged over 20% during the past six months

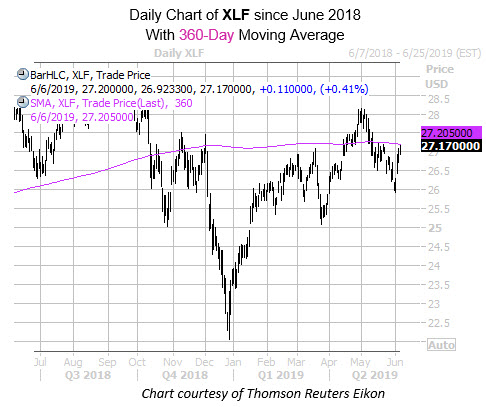

With mixed expectations around the Fed's next move, alongside a warning on increased trade disputes coming from the International Monetary Fund (IMF), the Financial Select Sector SPDR Fund ETF (XLF) has been drawing increased attention, specifically in the options pits. XLF has had a notable year on the charts, now up more than 23% from its December lows. Just today, in fact, the ETF has run into its 360-day moving average, a historic ceiling for the shares. As of last check, XLF is up 0.4% at $27.17.

The options pits are buzzing for XLF this afternoon, as more than 47,000 calls and 76,000 put options have changed hands -- nearly twice the expected pace. There's notable activity at the July 27 call and put, where spread activity have been detected.

It appears one trader bought $11,400 options in total, opening the 27-strike call for 64 cents each, while simultaneously buying to open of the 27-strike puts for 73 cents apiece for a total cash outlay of roughly $1.56 million ($1.37 paid per straddle * 100 shares per contract * contracts purchased). If the trader did initiate such a spread, he or she is betting on a volatile July for XLF, with breakeven on the upper end at $28.37, and breakeven on the downside at $25.63.

Put options have been popular on the ETF, with data from the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) showing XLF with a 10-day put/call volume ratio of 4.44, ranking in the 89th annual percentile. In other words, four puts have been purchased for every call during the past two weeks.