Tariffs are expected to assign an increase in rates among the insurance sector

Subscribers to Chart of the Week received this commentary on Sunday, June 29. Click here to get your hands on our critically-acclaimed 18- pick stock report.

It’s hard to believe that this time next week, we will have two quarters under our belt. The speed of which 2025 is not too surprising considering the second the ball dropped in January Wall Street has been inundated with tariff standoffs, rapid artificial intelligence (AI) integration, inflation stress (culminating in this week’s indirect faceoff between President Trump and Fed Chair Jerome Powell), Middle East bombings and subsequent ceasefires.

Markets have been on the rebound in the second quarter, with the Dow Jones Industrial Average (DJI) shifting from a Q1 loss of 1.28% to a 3.30% gain for Q2. This marks the index’s best quarter since September of last year. The tech-heavy Nasdaq Composite (IXIC) is rebounding off its 10.42% first-quarter drop, logging its best quarterly performance since late 2023, with a 16.58% pop. In its best quarterly performance since March 2024, the S&P 500 Index (SPX) carries a Q2 gain of 9.43%.

In early May, I discussed the headwinds that looked imminent for exchange traded funds (ETFs) during the upcoming month, and how investors were staring down increased supply chain disruptions and prices. After reviewing data from Schaeffer’s Senior Quantitative Analyst White and eyeing multiple support pieces that were moving into place, ETFs looked to be a more risk-adverse route for the bullish trader. This theory seems to have held true, with the SPDR S&P 500 Index (SPY) curling upward with a 9.7% second-quarter gain and the Technology Select Sector SPDR Fund (XLK) a 21.8% Q2 win.

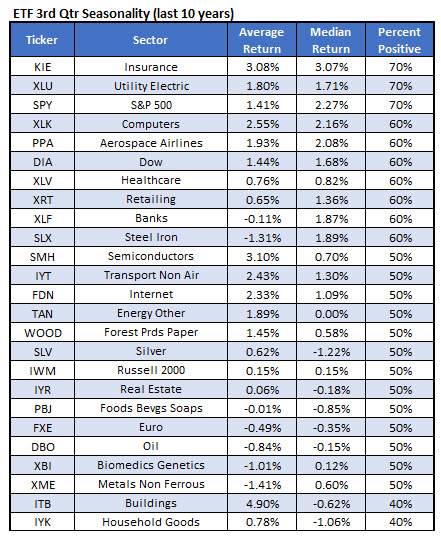

Per White, spanning the past decade, third quarter seasonality for ETFs has seen a spread of outperforming sectors. The top five are an interesting mx of cyclical and growth; semiconductors lead the way, but don’t count out utilities, insurance, or defense sectors. Chips top the list of 25 with the VanEck Semiconductor ETF (SMH) averaging a third quarter return of 3.10% but a less-than-stellar win rate of 50%. The Utilities Select Sector SPDR Fund (XLU) averages a 1.80% pop on a 70%-win rate for Q3 while the SPY comes in with a return averaging 1.41%, moving higher seven of the 10 instances as well.

But let’s focus on the silver medalist, SPDR S&P Insurance ETF (KIE) with its average return of 3.08% and a stellar 70%-win rate. Since the beginning of the year, KIE has put on an extremely volatile performance and now clings to a 4% year-to-date gain. The ETF is now benefiting from support at the ascending 200-day moving average, but has suffered losses of up to 7.45% (April 4), and climbed as much as 6.4% (April 9) within a one-week span. Several mode of resistance are at play as well, with the ETF now approaching the overhead trendline that formed at its late-November and late-March highs. The insurance ETF experienced a V-shaped rally from April to mid-May, but has since been trapped in a channel between $58 and $60.

The threat of tariffs is expected to assign an increase in rates among the insurance sector, as costs exceed an already inflated level. As prices climb for homebuilding supplies and automotive manufacturing parts, so does the cost of insurance. However, insurance tends to be one of the less volatile sectors. So while technical support could prove challenging for KIE, the fact that the historically stable sector tops the list of third-quarter seasonality makes these stocks a safe play regardless of risk appetite.