Oil & gas stocks tend to underperform in August, historically

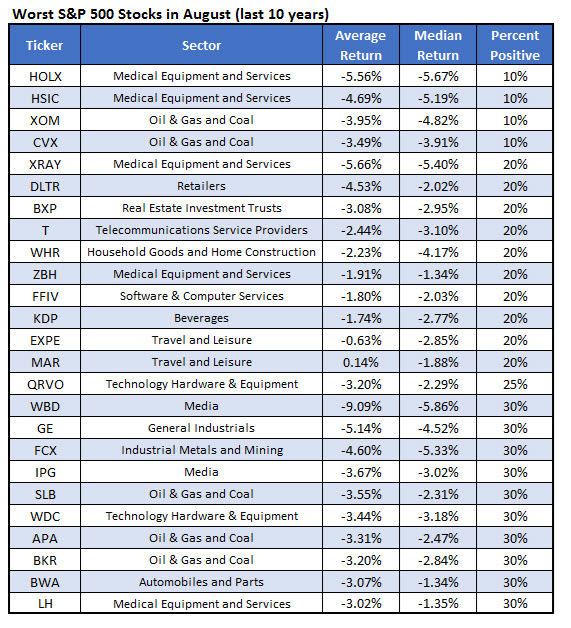

Last week, we partook in the tried-and-true, end-of-the-month ritual of identifying the best-performing stocks on the S&P 500 Index (SPX) for the coming month. Schaeffer’s Senior Quantitative Analyst Rocky White also identified the 25 worst-performing stocks for the month. For August, one trend sticks out — oil and energy stocks are in for a bumpy August, if past is precedent.

Five stocks from the energy sector historically underperform in August. Per the table below, Chevon Corporation (NYSE:CVX) and Exxon-Mobil Corp (NYSE:XOM) are two blue-chip stocks that average negative 4% and 3.5%, respectively, in August. Note the paltry win rate of 10% for both XOM and CVX as well. If August turns out to be a stinker, it will put both stocks further below their year-to-date breakeven level.

APA Corp (APA), Baker Hughes (BKR) and Schlumberger (SLB) have averaged negative returns of 3.3%, 3.2%, and 3.6%, respectively, all with slim win rates of 30%. From a broader sector perspective, the oil services exchange traded fund VanEck Vectors Oil Services ETF (OIH) is the worst-performing ETF we track in August, with an average loss of 3.9% and just a 40% rate.

Heading into August, there are a few macro storylines adjacent to the oil & gas sector that should be monitored. Petroleum demand continues to rise yet supply of ocean rigs remains limited. Keep an eye on any deals, such as Transocean’s (RIG) 7% pop after securing a three-year, $518 million contract to deploy one of its drill ships in the Gulf of Mexico. While fossil fuels have been a bugaboo for the last decade, some companies are quietly steering back into the reliable fuel supply.

On Aug. 3, the Organization of the Petroleum Exporting Countries and their allies' (OPEC+) will hold their Joint Ministerial Monitoring Committee (JMMC) to take the temperature – no pun intended – of the global oil market. OPEC has publicly predicted a tighter market in the second half of 2023, which could act as a headwind for oil prices.

A prudent contrarian investor should also participate in the American pastime of monitoring gas prices. Gasoline prices historically tend to be higher in the summer months, but August is the tapering off point as peak driving and vacation season winds down.