Bank stocks are under the microscope even more this earnings season

Just like Black Friday signals the start of the holiday shopping season, when you see financial giants in the news for their corporate reports, you know earnings season is nigh. It feels like bank stocks are under the microscope even more this time around, amid the rise of the 10-year Treasury yield, subsequent inflationary concerns, Bitcoin's ubiquity, and the (hopefully) final throes of the coronavirus pandemic.

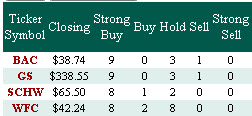

This week, Bank of America's (BAC) top-line beat prompted six price-target hikes from the brokerage bunch. Goldman Sach's (GS) earnings and revenue beat resulted in eight post-earnings price-target adjustments higher. After the dust settled, BAC's consensus 12-month price target is an 8.1% premium to Friday's closing perch, while GS' average 12-month price target is a 11.2% premium.

Earlier in the week, Wells Fargo (WFC) stock pulled back to a historically bullish trendline. Sure enough, WFC scored a post-earnings pop of 5.5%, no doubt fueled by the 11 price-target hikes. As the week comes to an end, WFC's analyst setup looks similar to its sector peers; its consensus 12-month price target is now a 10% premium to its current perch.

Those were the winners, but not every financial name was as lucky. Charles Schwab (SCHW) suffered a post-earnings dip of 3.9% despite its own top-line beat and two ensuing price-target hikes. That brought SCHW's 12-month average price target up to a 17% premium to its most recent perch.

All of this is a long-winded way of saying many financial names have their optimism already baked in. It's not just price-target; the majority of analysts rate BAC, GS, WFC, and SCHW at a "buy" or better, so don't expect a shift in analyst sentiment to serve as a contrarian tailwind going forward.

Two more notes to consider as more bank earnings trickle in. First, keep an eye on Bitcoin and cryptocurrencies, as the direct listing of Coinbase Global (COIN) on the Nasdaq – the first listing the Nasdaq has ever sponsored -- captured investor attention last week as one of the biggest listings in the last decade. It's a paradigm shift for decentralized finance, or "defi," as it continues to burrow into the mainstream. Keeping a finger on the pulse of how this shifts the tectonic plates of traditional financial institutions will be important for investors.

Lastly, there could be seasonal headwinds on the horizon for financial names. Per Schaeffer's Senior Quantitative Analyst Rocky White, with an assist from Schaeffer's Senior Market Strategist Chris Prybal, summer isn't the best time for bank stocks. Looking at equity returns from May 1 to August 31 going back to 2010, all of the bank names just mentioned – plus JPMorgan Chase (JPM) for good measure – sport uninspiring returns.

Subscribers to Bernie Schaeffer's Chart of the Week received this commentary on Sunday, April 18.