NOG just pulled back to a historically bullish trendline on the charts

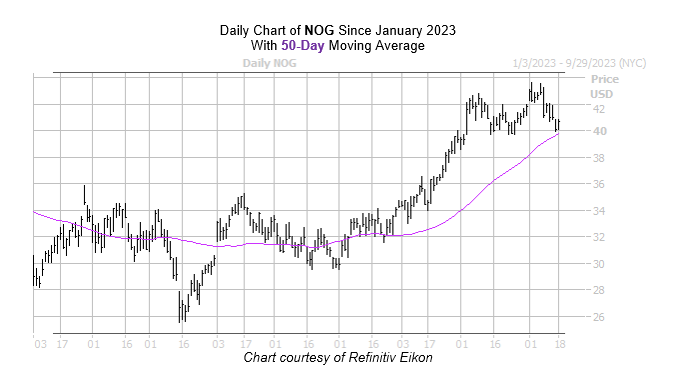

Northern Oil & Gas Inc (NYSE:NOG) stock survived the broader market's August pullback, hitting a roughly five-year high of $43.64 on Sept. 5. The shares have pulled back since then. However, there is reason to believe the stock could soon stage another bounce higher, as it has just run into a trendline with historically bullish implications.

NOG is trading within one standard deviation of its 50-day moving average for the fifth time in the past three years. According to Schaeffer's Senior Quantitative Analyst Rocky White, the equity was positive one month later after half of these signals, averaging a 5.2% return. A similar move from the stock's current perch at $40.71 would push the shares near the $43 level -- home to its 2023 highs.

Northern Oil & Gas stock could also benefit from an unwinding of options traders' pessimism. In fact, the security's 50-day put/call volume ratio of 2.88 at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) ranks in the 94th percentile of its annual range.

Now looks like a good time to weigh in on NOG with options, too, per its Schaeffer's Volatility Index (SVI) of 29%, which ranks in the low 8th percentile of its annual range. This means options traders are pricing in low volatility expectations at the moment.

It's also worth noting that short interest represents 9.8% of the stock's available float. It would take shorts over six days to cover their bets, leaving plenty of pent-up buying power.