MPC has pulled back to a historically bullish trendline on the charts

Marathon Petroleum Corp (NYSE:MPC) will report earnings ahead of the open tomorrow, May 2, in which analysts anticipate profits of $5.74 per share. The options pits are pricing in a 4.8% post-earnings swing, regardless of direction, which is slightly larger than the 3.2% move the stock has averaged over the last two years. Ahead of the event, MPC also happens to be near a trendline with historically bullish implications.

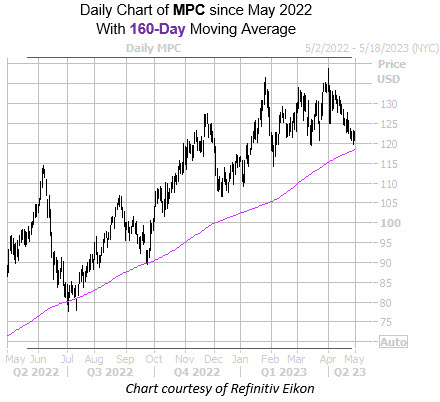

The stock is trading within one standard deviation of its 160-day moving average for the fifth time in the past three years. According to Schaeffer's Senior Quantitative Analyst Rocky White, MPC was positive one month later 100% of the time, averaging an 11.6% gain. A similar move from the stock's current perch at $122.26 would push it above $136, or a new record high.

It's also worth noting that the oil name's 14-day relative strength index (RSI) of 28.4 sits in "oversold" territory, which typically indicates a short-term bounce.