The video game maker reported a first-quarter earnings beat

Activision Blizzard, Inc. (NASDAQ:ATVI) stock down 11.3% to trade at $76.96 at last check, on track for its worst single-session percentage drop in nearly two years. While the video game company scored a first-quarter earnings beat, U.K. regulators are moving to block Microsoft's (MSFT) $69 billion acquisition of the video game publisher. The U.K. Competition and Markets Authority (CMA) said concerns over competition in the nascent cloud gaming market led to the opposition.

Options volume today is running at 10 times the average intraday amount, with 109,000 calls and 145,000 puts changing hands so far today. Most popular is the May 75 put, followed by the 80 put in the same standard series.

This penchant for bearish bets isn't anything new, per the equity's Schaeffer's put/call open interest ratio of 1.06 that stands in the 89th percentile of annual readings. This high reading implies short-term options traders have rarely been more bearish over the last 12 months.

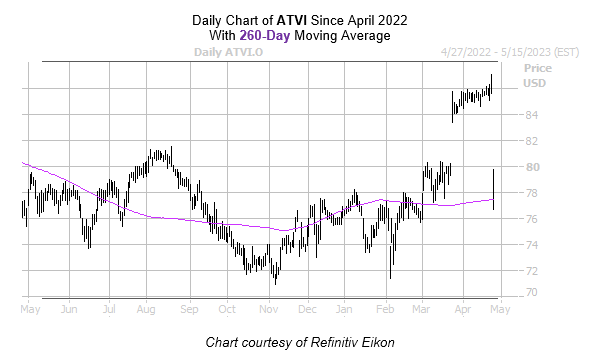

Activision Blizzard stock is trading at its lowest level since February, moving well below late-March bull gap. Keep an eye on two levels going forward; ATVI's 260-day moving average that has contained today's drawdown, as well as the stock's now-fractional year-to-date lead.