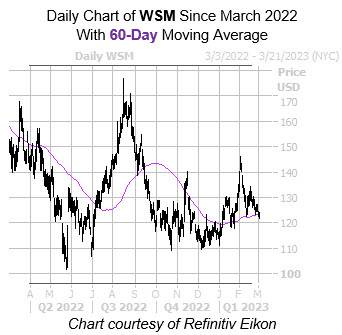

The security is looking to bounce off its 60-day moving average

The shares of Williams-Sonoma, Inc. (NYSE:WSM) are down 0.7% to trade at $122.69 this afternoon, as shares continue to cool down from an early February rally to the $146 region -- their highest level since September. Though the security still carries an 18.1% year-over-year deficit, it has added 6.8% so far in 2023, and may soon extend its lead thanks to a historically bullish trendline.

More specifically, WSM is within one standard deviation of its 60-day moving average. Per Schaeffer's Senior Quantitative Analyst Rocky White's latest study, the equity saw five similar signals over the last three years, and was higher one month later 80% of the time to average an 11.6% gain. A move of similar magnitude from its current perch would place shares just shy of $137.

Short sellers are already hitting the exits, with short interest down 7.2% in the last two reporting periods. The 9.55 million shares sold short still account for 14.5% of Williams-Sonoma stock's available float, suggesting a further unwinding of pessimism may also boost the shares.

Additional tailwinds could stem from a sentiment shift among short-term options traders. This is per the stock's Schaeffer's put/call open interest ratio (SOIR) of 3.01, which sits in the 90th annual percentile, meaning these traders have rarely been more put-biased.