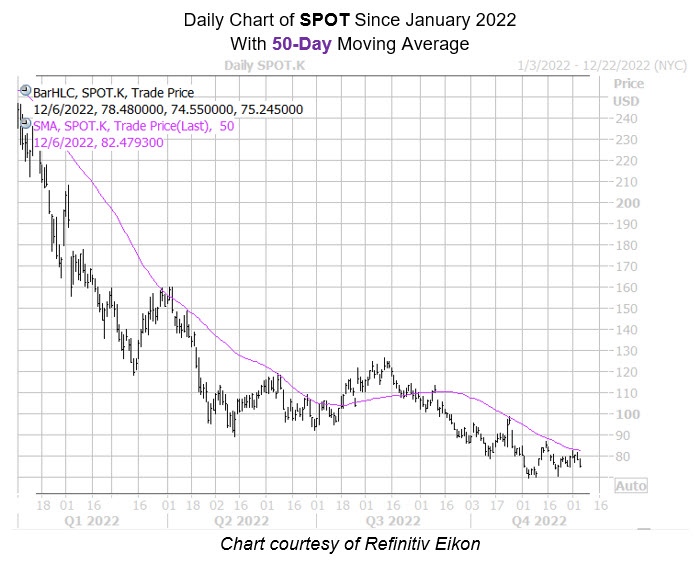

The 50-day moving average is still looming overhead

Spotify Technology S.A. (NYSE: SPOT) is the company behind the most popular audio streaming platform in the world, with presence in 183 markets. The platform offers a subscription service with more than 82 million tracks and over 4 million podcast titles. It currently has 433 million monthly active users and 188 million premium subscribers. At last glance, Spotify stock is trading down 4.2% at $75.08.

SPOT is down by about 66% year-over-year and has shed 67% year-to-date. However, the stock has grown by 8% over the past month, pushing it 13% up from its early November record low of $69.28. Still, Spotify stock is struggling, with overhead pressure looming at the 50-day moving average.

Nonetheless, Spotify holds a strong balance sheet with $3.67 billion in cash and $1.86 billion in total debt, helping to balance out some of the short-term risks for the business. As a result, SPOT can be considered one of the more attractive high risk, high growth plays available on the market at the moment.