C3.ai stock's history of post-earnings moves leaves lots to be desired

Artificial intelligence (AI) software provider C3.ai Inc (NYSE:AI) is headed to the earnings confessional, with its fourth-quarter report due out after the close on Wednesday, Dec. 7. Ahead of the event, analysts are expecting the company to report losses of 16 cents per share. Let's unpack the stock's recent chart performance below, as well as some of its previous post-earnings responses.

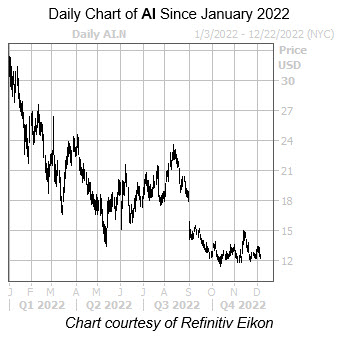

C3.ai stock has struggled with a ceiling at the $15 level since September, falling short of that level during its November rally. The security was last seen down 2.7% at $12.22, as a floor at the $12 region continues to cap losses, preventing shares from slipping below their Oct. 13, all-time low of $11.30. Year-to-date, AI is down 60.9%.

The security's history of post-earnings moves isn't pretty, with shares finishing all but one of eight next-day sessions lower, including a massive 19% drop in September. AI averaged a move of 10.6% in the last two years, regardless of direction, but this time around the options pits are pricing are in a much bigger swing of 20.1%.

Nevertheless, options traders have been bullish. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), the stock's 50-day call/put volume ratio of 7.30 sits in the 99th percentile of its annual range. This indicates long calls have been getting picked up at a faster-than-usual clip in the past 10 weeks.

Short-term options traders echo that optimism. This is per the security's Schaeffer's put/call open interest ratio (SOIR), which sits higher than just 7% of readings from the past year.

Though shorts have been hitting the exits of late, they remain in control. Short interest has dipped 23.5% over the last two reporting periods, yet the 9.35 million shares sold short still account for 10.3% of C3.ai stock's available float, or more than one week's worth of pent-up buying power.