Plus, 25 more stocks to avoid in December

The end of the year is right around the quarter, and it's time to highlight the best and worst stocks to own in December. Yesterday, we showed why investors should steer clear of Best Buy stock, and we're back with another retail stock that should be avoided: Bath & Body Works Inc (NYSE:BBWI).

According to a list of 25 stocks with the worst returns this month, per Schaeffer's Senior Quantitative Analyst Rocky White, Bath & Body Works stock is the second-worst retail stock to own in December. over the last 10 years, the equity has finished the month lower seven times, averaging a 4.5% loss. From its current perch of $44.47, the shares would fall back to the $42 level.

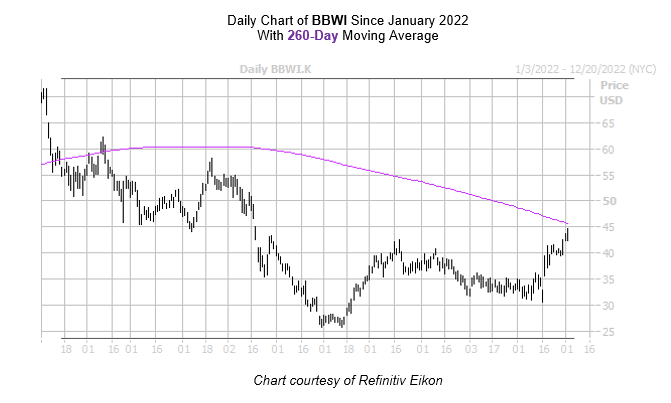

While BBWI was last seen sporting a 36.3% quarter-to-date lead, the shares remain down 36.3% in 2022. Overhead pressure from the 260-day moving average is keeping a lid on today's gains, as Bath & Body Works stock moved above the $44 level for the first time since May.

Analysts are overwhelmingly optimistic towards the equity, and a shift in this sentiment could weigh on the shares. Specifically, 14 of the 17 covering brokerages rate BBWI a "buy" or better. Meanwhile, the 12-month consensus target price of $49.79 is a 12% premium to the stock's current perch.