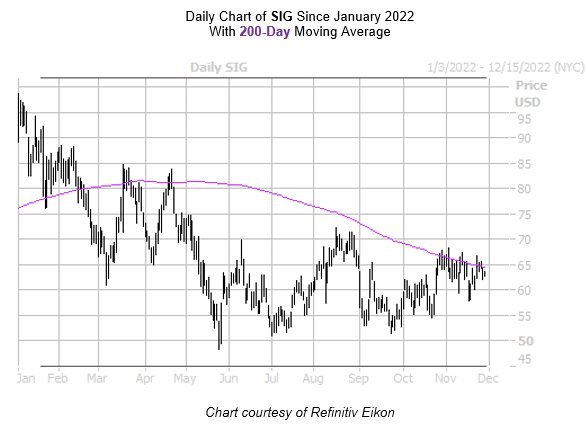

The stock is now trading near a historically bearish trendline

Shares of luxury retailer Signet Jewelers Ltd. (NYSE:SIG) are 1.6% higher today to trade at $63.71. The stock is holding well above its May annual low of $48.31, and holds a 10.8% quarterly lead. However, today's pop has SIG trading near a historically bearish trendline that pressure the shares lower once again.

Per data compiled by Schaeffer's Senior Quantitative Analyst Rock White, Signet Jewelers stock has recently come within one standard deviation of its 200-day moving average, following an extended period below the trendline. The equity has seen five similar pullbacks within the past three years, which has resulted in an average 21-day loss of 7% in 60% of the circumstances.

Options traders have been betting bullishly of late. In fact, at the the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), 5.77 calls have been bought for every put over the last 10 days-- a ratio that sits higher than 95% of all other readings from the past year. An unwinding of this optimism could put additional pressure on SIG.