Tyson Foods stock is flashing a historically bullish signal

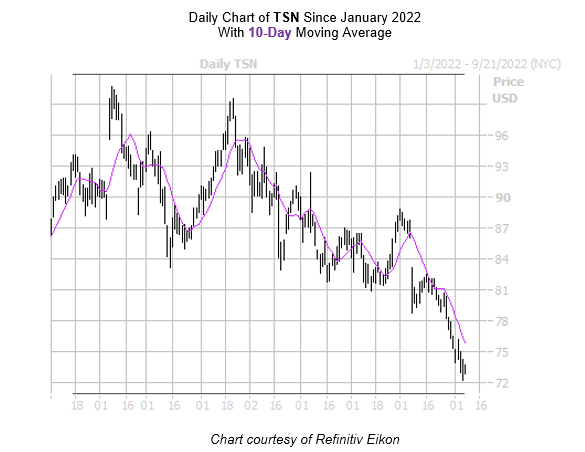

Tyson Foods, Inc. (NYSE:TSN) has been slipping on the charts, on its way to its sixth-straight losing week -- its longest since 2018. Last seen inching 0.5% lower to trade at $73.52, the equity is adding to its 16% year-to-date deficit. Pressure from its 10-day moving average began pushing TSN down the charts around mid-August, however, there's reason to believe Tyson Foods stock could soon buck this downward trend and make a break higher.

This rout comes amid historically low implied volatility (IV) -- a bullish combination for TSN in the past. A study from Schaeffer's Senior Quantitative Analyst Rocky White reveals that two other similar signals occurred over past five years when the security was trading within 5% of its 52-week low while its Schaeffer's Volatility Index (SVI) stood in the 40th percentile of its annual range or lower -- true for TSN which sports an SVI of 24% which stands higher than just 26% of readings from the past year.

This study shows that one month after these two signals Tyson Foods stock was higher, boasting an average return of nearly 4.1%. From its current perch, a move of similar magnitude would put the equity over the $76.50 mark. What's more, TSN's 14-day Relative Strength Index (RSI) of 23.9 sits firmly in "oversold" territory, which is indicative of an upcoming short-term bounce.

An unwinding of pessimism in the options pits could help put wind at TSN's back. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), the security's 50-day put/call volume ratio of 1.48 ranks in the 88th percentile of its annual range. This indicates puts have been picked up more than calls and at a quicker-than-usual clip to boot.

A shift amongst the brokerage bunch could also have bullish implications. Of the eight analysts in coverage, seven still rate the shares a "hold," and the 12-month consensus price target of $92.33 is a 25.4% premium to its current level of trading.