Dropbox will report earnings after tomorrow's close

Dropbox Inc (NASDAQ:DBX) will enter the earnings confessional after the close tomorrow, Aug. 4. Analysts are expecting the cloud software company to post profits of 37 cents per share and show a rise in revenue for its second quarter. At last check, DBX was up 3% at $23.50.

The equity has a shaky history of post-earnings moves, going back two years, with just two of these eight instances ending in positive next-day returns. Regardless of direction, the security averaged a next-day swing of 4.5% during this time period, which is much smaller than the 8.7% move the options pits are pricing in this time around.

Dropbox stock's options pits have been quite bearish. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), DBX sports a 10-day put/call volume ratio of 1.31, which stands higher than 92% of readings from the past year. This implies that puts are being picked up at a much quicker-than-usual clip of late.

Short-term options traders have also been incredibly put-heavy recently. This is per DBX's Schaeffer's put/call volume ratio (SOIR) of 2.23, which sits higher all readings from the past year.

Analysts have remained optimistic, however. Of the five in coverage, all but one call DBX a "strong buy." Plus, the 12-month consensus price target of $27.42 is a 16.8% premium to current levels.

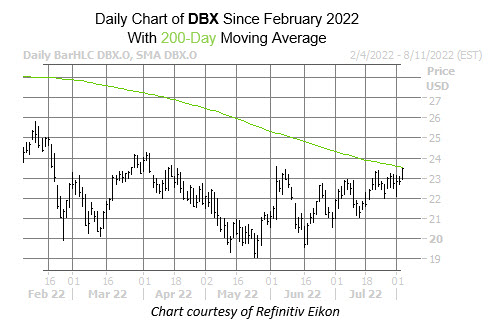

Today's positive price action could send the stock to its highest settlement since April, should these gains hold. However, pressure at the 200-day moving average appears to be cutting this rally short, keeping the security at a 4.1% year-to-date deficit.