Subsidiary elf SKIN just launched new products and an awareness campaign

elf Beauty Inc (NYSE:ELF) is bucking today's broader market selloff, last seen up 8.6% to trade at $30.97. While a catalyst for the upbeat price action was not immediately available, earlier this month subsidiary e.l.f. SKIN launched new skincare products, and announced an awareness campaign that introduced board-certified dermatologist and assistant professor of dermatology at the University of Minnesota Medical School Jing Liu as its ambassador.

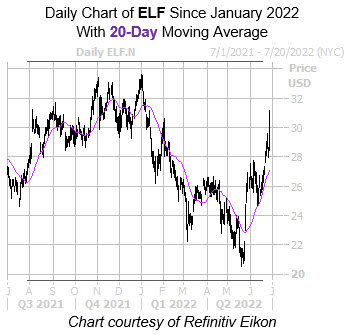

Today's surge has elf Beauty stock looking to close at its highest level since January. The equity conquered the support of the 20-day moving average after bouncing off a May 20, one-year low of $20.49, and has added almost 20% in the last three months.

Options traders are seemingly not convinced, though. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), elf Beauty stock's 50-day put/call volume ratio of 4.34 sits higher than 98% of readings from the past year. Echoing this is ELF's Schaeffer's put/call open interest ratio (SOIR) of 1.08, which ranks higher than 96% of reading from the last 12 months.

ELF is projected to see a 3.6% decrease in earnings, and a 12.2% increase in revenues for 2023. Estimates also have the company growing earnings and revenue by 9.9% and 7.9%, respectively, in 2024.

Nonetheless, elf Beauty stock continues to be overvalued by most valuation metrics. ELF provides relatively weak fundamentals for an extremely high price-earnings ratio of 69.78, and an inflated price-sales ratio of 3.91. The cosmetics concern also has $43.35 million in cash, and $117 million in total debt on its balance sheet. Plus, ELF trades at a forward price-earnings ratio of 35.71, which is a rich value considering its growth rate. In other words, elf Beauty stock has little to offer from both a value and growth standpoint.