Marathon Oil stock tends to disappoint in July

It's been a rocky time on Wall Street lately, and the first half of 2022 certainly posed a challenge for investors. As we start getting into the second part of the year, it's a good idea to keep an eye on stocks that half had a tendency to underperform in July. For your convenience, we have compiled a list of the worst stocks to own during this time, with Marathon Oil Corp (NYSE:MRO) standing out amongst them.

According to Schaeffer's Senior Quantitative Analyst Rocky White, Marathon Oil stock averaged a July loss of 4.6% over the past 10 years, finishing the month positive only four of these times. Oil & gas stocks are all over this list, historically, even without the recent pressure from the government due to rising fuel costs.

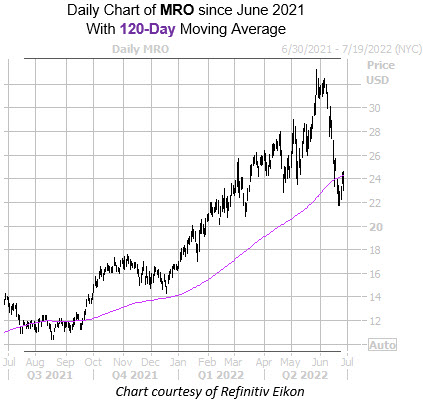

Today, MRO is down 4.8% to trade at $22.97, and facing pressure at the 120-day moving average, after recently breaking below it for the first time since September 2021. Year-to-date, the equity is still up 40.1%, but has been on its way lower.

Options traders have been betting on a move higher, and an unwinding of this optimism could provide headwinds. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), MRO's 10-day call/put volume ratio of 5.33 ranks in the elevated 85th percentile of its annual range, showing a heavy penchant for calls lately.

A round of downgrades could send the stock lower, too. Of the 16 analysts in coverage, 13 carry a "strong buy" rating. Plus, the 12-month consensus price target of $34.12 is a 48.6% premium to current levels.