Plus, another 24 stocks that tend to outperform during this time of the year

With April coming to a close, traders have the chance to revisit their portfolios and make the necessary adjustments. One stock worth keeping a particularly close eye on in May is CME Group Inc (NASDAQ:CME). Below, we will further explore the security's chart performance, and why it may offer a solid investment opportunity over the next month.

Digging deeper, CME Group stock appeared on Schaeffer's Senior Quantitative Analyst Rocky White's list of best S&P 500 Index (SPX) stocks in May in the last decade. More specifically, CME averaged a 4.3% jump for the month, notching a positive settlement during nine out of those 10 years, marking it as the best brokerage services name on the list.

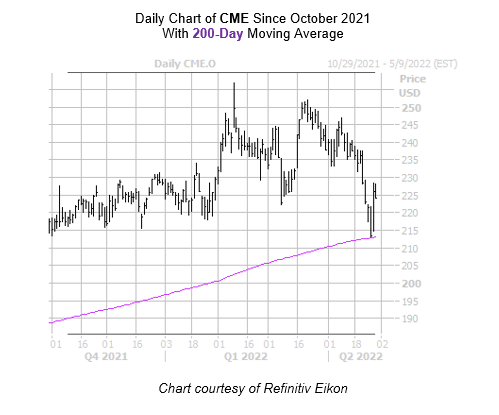

Coincidentally, CME Group stock just pulled back to the historically bullish 200-day moving average. A separate study from White shows that over the last three years, the equity has pulled back to this key trendline twice, and averaged a 3.6% jump for both of these occasions. A comparable move from its current perch of $223.65 would put CME over the $231 mark. In combination with its historically bullish returns for the month of May, though, CME has a solid shot at moving back toward its Feb. 9, record high of $256.94.

A shift in the options pits could create additional tailwinds for the shares. At the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), CME's 10-day put/call volume ratio of 2.58 sits higher than 90% of readings in its annual range. This means puts are getting picked up at a much quicker-than-usual pace.

Further, an unwinding of pessimism among the brokerage bunch may result in additional support. This is per the eight of 11 analysts in coverage that still rate CME Group stock a "hold" or worse.