Walgreens Boots Alliance is gearing up for Q4 earnings on Thursday, Oct. 14

Blue-chip name Walgreens Boots Alliance Inc (NASDAQ:WBA) just announced two major leadership appointments. More specifically, Holly May will now serve as executive vice president and global chief human resources officer, while Anita Allemand will step in as chief transformation and integration officer. Plus, the company is gearing up for its fiscal fourth-quarter earnings call, which is due out before the open on Thursday, Oct. 14. Below, we will explore the equity's technical performance and previous post-earnings activity.

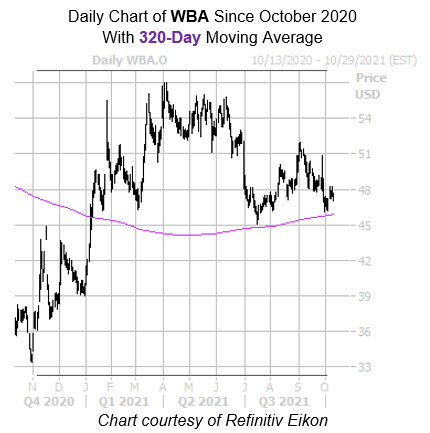

On the charts, Walgreens Boots Alliance stock has struggled with volatility over the last 12 months. The $52 level kept a tight lid on the stock's early September rally, though the $46 mark has contained the equity's latest pullback, while the 320-day moving average has been a solid source of support since January. Year-over-year, WBA remains up 28.6%. At last check, the stock is flat, up 0.1% to trade at $47.45.

The security has a mixed history of post-earnings reactions. Over the past two years, WBA finished four of these eight next-day sessions lower, including a 7.8% drop in August of 2020. Options traders are pricing in a 7.9% swing for the security this time around, which is higher than the 5.2% move Walgreens Boots Alliance stock averaged after its last eight reports, regardless of direction.

Analysts are skeptical towards the equity, with nine of the 11 in question calling WBA a tepid "hold" or worse. Should some of that pessimism begin to unwind, the shares could move higher. Meanwhile, the 12-month consensus target price of $51.62 is an 8.7% premium to the stock's current perch.