Danaher stock scored a record high on Monday

Danaher Corporation (NYSE:DHR) is a global science and technology conglomerate. Recently, on Aug. 30, the company announced the completion of its acquisition of Aldevron, expanding its capabilities into the important field of genomic medicine.

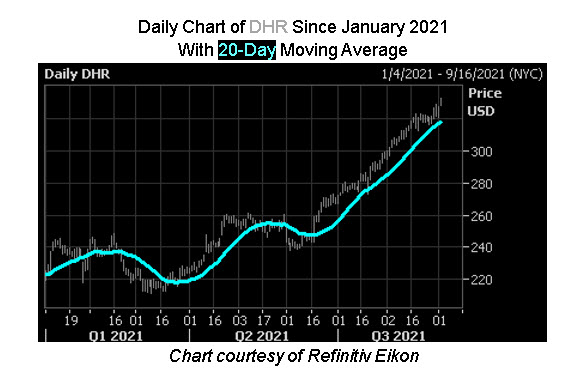

Danaher stock is up 49% in 2021, and scored a record high of $329.47 on Aug. 31 in the wake of the acquisition news. Along the shares' channel of higher highs carved out since mid-June, their 20-day moving average has guided DHR higher.

A sentiment shift in the options pits could push shares even higher. This is per DHR's Schaeffer's put/call volume ratio of 1.18 (SOIR), which sits higher than 98% of readings in its annual range. This indicates short-term traders have rarely been more put-biased.

In general, the most promising aspect of Danaher stock has been its recent growth. The company’s trailing 12-month revenues have grown 20% compared to what was reported for fiscal 2020 and have grown 49% since fiscal 2019. In addition, DHR's 12-month net income has increased by 54% compared to what was reported for fiscal 2020 and has increased 87% since fiscal 2019.

Nonetheless, at a price-earning ratio of 43.58 and forward price-earnings ratio of 37.45, Danaher stock comes with its fair share of risks. Another risk one being DHR's balance sheet, which includes $7.32 billion in cash and $20.53 billion in total debt. The company also experienced significant revenue and net income declines in fiscal 2018, further adding its list of risks. Overall, investors may be best suited waiting for a better entry price into Danaher stock. However, the company's recent growth has made DHR an intriguing speculative play for long-term investors.

Now looks like a great opportunity time to weigh in on Danaher stock's next move with options. The equity's Schaeffer’s Volatility Index (SVI) of 19% sits higher than 6% of readings from the past 12 months. Plus, its Schaeffer's Volatility Scorecard (SVS) stands at 88 out of 100, indicating the equity has exceeded options traders' volatility expectations over the past year -- a boon for buyers.