.jpg?sfvrsn=5f47d706_4)

A straddle strategy can help options players navigate volatility

About a month ago, I wrote about the extremely low historical volatility reading for the S&P 500 Index (SPX). Low volatility on the index does not necessarily mean a lack of opportunities for option traders. With well over a thousand stocks out there with suitable option liquidity, there are bound to be some stocks where opportunities lie. Below, I calculated monthly straddle returns for stocks over the past couple of years, summarized the data, and listed some stocks that option traders have mispriced the most.

Finding Stocks with Mispriced Options

To determine stocks that have had attractive options, I calculated returns on straddles over the past two years. A straddle consists of buying a call option and a put option on a stock. The call and put should have the same strike and expiration date. This takes direction out of the equation, because the position can profit whether the stock goes up or down. The stock move, however, must be bigger than simply buying a call or put because it must be enough to cover both premiums that you bought.

Summarizing Straddle Returns: Notable Stock Lists

The data below assumes you purchased an at-the-money straddle a little over a month before expiration. I did this for each regular monthly expiration day (the third Friday of the month) over the past two years. This time frame is analogous to purchasing a straddle that expires on Friday, August 20th. It assumes you held it through expiration and closed it at intrinsic value.

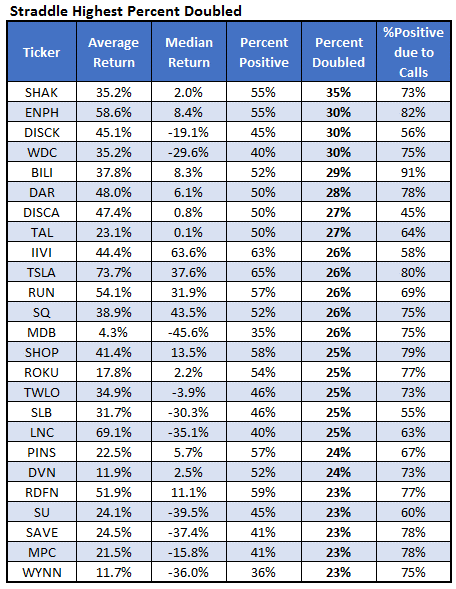

Going by the average straddle return, the table below shows the top 25 stocks for straddle plays over the past two years (using this method). I also show the median straddle return, the percent that were positive, and the percent which would have doubled your money. The last column shows the percentage of the positive straddles that were positive due to the call option. In other words, of all the positive straddles, it is the percentage that were positive due to an increase in the stock price as opposed to a decrease in the stock price. These stocks were much more volatile than what option players had priced in.

Below is another list of 25 stocks that were good straddle plays over the past couple of years. These are stocks that had the highest percent positive. These stocks may not have earned you the most money with their straddles, but they turned out winners more consistently than others.

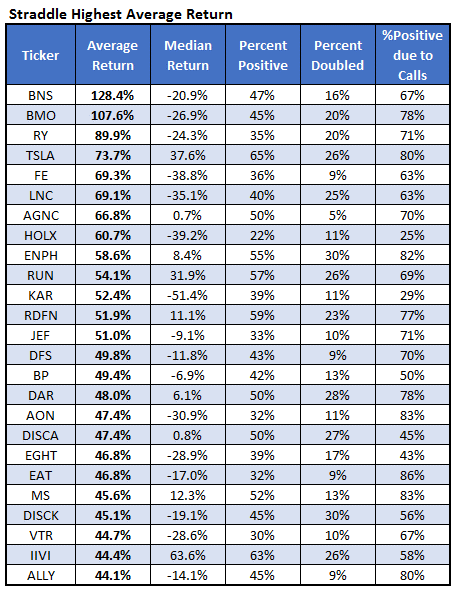

Lastly, here is a list of stocks whose straddles doubled most often. These stocks had options that were most likely to give you a big winner.