Checking in with the packaged food producer ahead of its quarterly report

The shares of Conagra Brands Inc (NYSE:CAG) are flat this afternoon, last seen down 0.1% at $36.15. That's not a bad thing, considering the broad market selloff most stocks are mired in right now. Investors are gearing up for the packaged food producer's fiscal fourth-quarter earnings report, due out before the open on Tuesday, July 13. Below, we'll dig into Conagra stock's technical setup ahead of the event, and what investors might be able to expect after its report.

Conagra stock has a history of mostly positive post-earnings reactions during the past two years, including a 15.9% next-day pop in December 2019. The equity did slip 12.1% after its September 2019 earnings report. CAG has averaged a next-day return of 5.8% regardless of direction, which falls in line with the 5.4% move options traders are pricing in this time around next week.

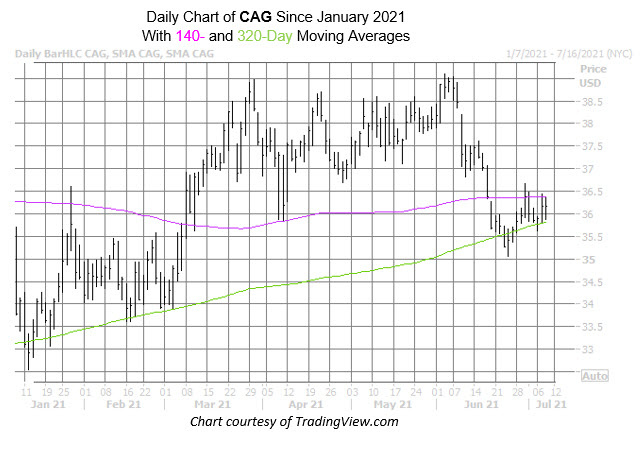

The stock's performance on the charts of late leaves something to be desired. CAG gapped below its year-to-date breakeven near the $36.40 level late last month. The shares have been consolidating just below here since, combined with the 140-day moving average, which has snuffed out any upside in the last week. The stock still has a chance to find its footing at the 320-day moving average, however, and it now sports a six-month lead of 7%.

It's no surprise then, that analysts aren't putting much faith in CAG right now. The stock sports just one "strong buy" rating of the six in coverage. Short sellers, meanwhile, have been piling on ahead of CAG's earnings. Short interest rose 18.1% in the last two reporting periods, and now represents almost a week of pent-up buying power, at the stock's average daily pace of trading.

There are a few bullish holdouts over in the options pits, though. the equity's 50-day call/put volume ratio of 2.83 at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) stands higher than 81% of readings from the past year. This suggests a penchant for long calls of late. Given the bevy of short sellers flocking to the equity, its possible some of these shorts could be using calls as an options hedge.