Goldman Sachs stock has seen positive returns in July in nine of the past 10 years

With a stellar first half of the year for Wall Street in the rearview mirror, investors are speculating on potential gains for the latter half -- and things are looking good. Bank stocks have attracted considerable attention of late, as volatile 10-year Treasury yield movements resulted in a recent selloff in the sector. However, this pullback may be the perfect opportunity to jump on Goldman Sachs Group Inc (NYSE:GS). Though the was last seen down 0.7%, trading at $367.22, it boasts a 84.4% year-over-year lead. In addition, GS is just one month removed from a June 7, all-time high of $393.26, and there's reason to believe that level could soon be within reach once again.

Digging deeper, Goldman Sachs stock just made it onto Schaeffer's Senior Quantitative Analyst Rocky White's list of the best performing stocks on the S&P 500 in July, going back 10 years. The security has seen positive monthly returns during this time period nine out of ten times, with a 4% pop on average. This means a move of similar magnitude from its current perch would put GS at nearly $382 -- leaving about 3% between the equity and its aforementioned all-time high.

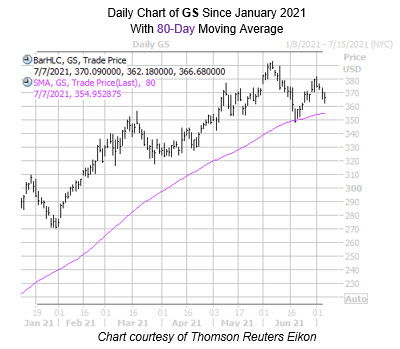

On the charts, Goldman Sachs stock is pacing for a fourth-straight loss. The last time the equity saw a similar streak of losses, it bounced off the $348 level -- which coincides with the 80-day moving average -- in mid-June, to subsequently climb above $380 by the beginning of July.

A shift in sentiment over in the options pits could create additional tailwinds for Goldman Sachs stock. This is per the security's 50-day put/call volume ratio at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), which sits in the 74th percentile of its annual range. In other words, long puts are being picked up at a faster-than-usual clip.

Echoing this, the equity's Schaeffer's put/call open interest ratio (SOIR) of 1.28, which sits higher than 84% of readings from the past year. This means short-term options traders have been more put-biased than usual.

What's more, GS premiums are a bargain at the moment. The security's Schaeffer's Volatility Index (SVI) of 29% stands higher than 18% of readings in its annual range, suggesting options traders have rarely priced in lower volatility expectations during the past 12 months.