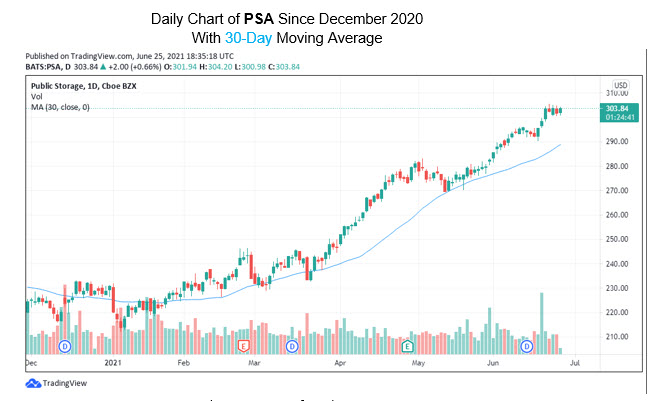

PSA is coming off an all-time record high

Public Storage (NYSE:PSA) is one of the world’s largest owners, operators, and developers of self-storage facilities. PSA operates about 2,500 facilities and serves more than one million customers across the United States, Canada, and Europe. Public Storage has a market cap of roughly $53.1 billion.

Public Storage stock boasts a roughly 60% year-over-year rise, with solid support from several moving averages, including its 30-day, which captured a brief pullback in May. What's more, the equity is coming off an all-time high of $305.59, hit on June 22, but looks to have found a floor at the $300 mark -- a level it finally toppled earlier in the week. The stock also has a forward dividend of $8.00 and a dividend yield of 2.65%.

PSA has outperformed earnings expectations on just one of its last four earnings reports. The earnings announcements for the second, third and fourth quarter of 2020 all swung and missed estimates. Finally, in the earnings report for the first quarter of 2021, Public Storage reported an increase in quarterly earnings and outperformed expectations by a decent margin of $0.44. The company's next earnings release is slated for Tuesday, Aug. 3.

From a fundamental point of view, however, Public Storage stock is undoubtedly overvalued. Despite PSA's consistent revenue growth, Public Storage has only increased its revenues by 11% since fiscal 2017. On the bottom-line, Public Storage has experienced back-to-back annual declines for the past two fiscal years, which adds up to a 26% decrease in net income between fiscal 2018 and fiscal 2020.

Even further, Public Storage's balance sheet is in bad shape with $2.54 billion in total debt and only $257 million in cash. Public Storage stock also has an inflated price-earnings ratio of 38.61, making it less appealing as a potential value play. There aren’t many positive arguments to be made for Public Storage’s fundamentals other than its consistent revenue growth. Nonetheless, for those seeking safer dividend plays, Public Storage stock offers a decent dividend yield, and the security of being one the biggest companies in the storage industry.