Should investors pay a premium for the apparel retailer?

The shares of apparel retailer Ralph Lauren Corp (NYSE:RL) are down 2.8% to trade at $132.78 this afternoon. Despite today's negative price action, the security is going into its fourth-quarter earnings report -- which is due out before the open tomorrow, May 20 -- with a 92.2% year-over-year lead. Below, we will take a closer look at how the equity has performed on the charts as of late, and explore how shares have typically behaved post-earnings.

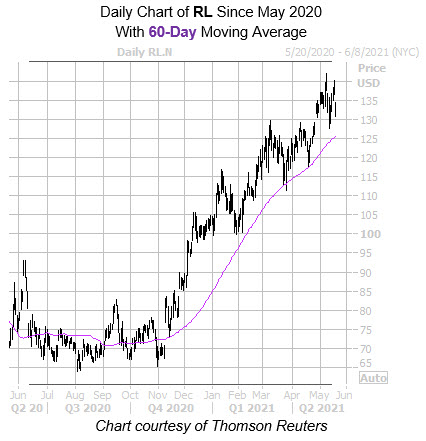

Digging deeper, Ralph Lauren stock is fresh off a May 10, three-year high of $142.06. The 60-day moving average has been a constant source of support for the equity since mid-November, while the $128 area contained a couple of the stock's latest pullbacks earlier this month.

A look at the RL's history of post-earnings reactions over the past two years shows a generally negative response. During its last eight reports, five of these next-day sessions were lower, including an 5% drop in October. The equity averaged a post-earnings swing of 5.5% in the last eight quarters, regardless of direction. This time around, the options market is pricing in a much bigger move of 9%.

The security isn’t the most consistent, or best valued at the moment. Although RL's forward price-earnings ratio of 20.08 is decent for today’s standards, the company has struggled to demonstrate sales growth in recent years. For instance, its revenues fell 2.5% in fiscal 2020, which ended going into the Covid-19 pandemic and subsequent lockdowns. With the company gearing up to release fiscal 2021 financial results, it is almost inevitable that Ralph Lauren will report yet another year of declining sales.

The company's trailing 12-month revenues are down 29% in comparison to fiscal 2020, and could decrease even further. The bottom-line isn't any better, either -- the retailer's 12-month net income stands at -$296 million, which is a $680 million decrease from fiscal 2020. Overall, Ralph Lauren stock does not present a good opportunity at its current valuation, despite revenues and net income inching towards pre-pandemic levels.