The stock has been steadily dropping on the charts since March

It's safe to say the shares of GameStop Corp. (NYSE:GME) have quieted a bit since the Reddit-fueled madness that turned the stock (and much of the broader market for a time) volatile late last winter. In April, the equity saw a relatively muted one-month drop of 8.6%, and it looks to be steadily sliding lower through May, down 16% so far. Of course, GME is still trading well above where it stood back before these speculators got their hands on the retail concern, boasting a year-over-year gain of 3,105.9%. This afternoon, GME is up 0.5% at $147.

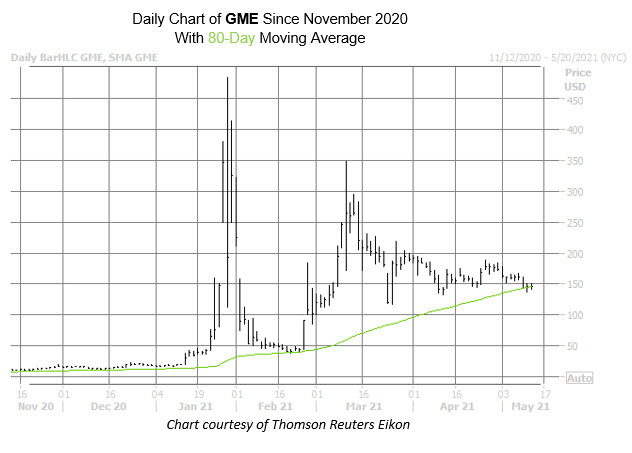

There's evidence the stock could stage a short-term bounce, too. Looking at one study from Schaeffer's Senior Quantitative Analyst Rocky White, data shows GME coming within one standard deviation of its 80-day moving average following a lengthy period above the trendline. GME has seen three similar moves during the past three years. One week after each of these signals, the stock was higher, averaging an impressive 60.8% return. from its current perch, a move of similar magnitude would put the security just below the $234 level, which sits near the low-end of its mid-March peak.

Clearly, the extreme volatility that erupted on the charts cannot be discounted for inflating this five-day return, though it should be pointed out that the trendline has acted as a trusty floor for GameStop since its penny stock days back in August 2020. The $150 region could provide an additional buffer as well, as its captured several pullbacks since March.

Short sellers are beginning to climb back on the bearish bandwagon with GME. Short interest rose 10.5% in the last two reporting periods, and now makes up a hefty 20.8% of the stock's available float.

Meanwhile, the options pits are pricing in relatively low volatility expectations for GameStop stock. The security's Schaeffer's Volatility Index (SVI) of 105% stands higher than only 7% of readings from the past 12 months. In other words, GME options can be had at an affordable premium right now.