The stock has a history of volatile post-earnings moves

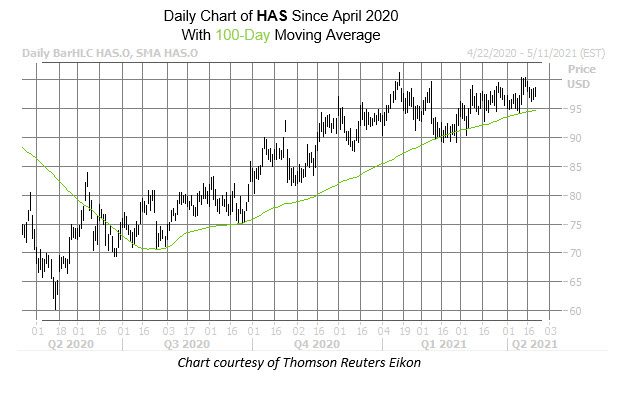

The shares of toy maker Hasbro, Inc. (NASDAQ:HAS) have made a valiant effort to reclaim their post-pandemic levels, staging a hard rally off their March 2020 spiral with solid support from several moving averages, including the 100-day, which has captured several pullbacks since June. The stock does seem to have hit a wall in 2021, however, with pressure near the $100 level emerging as a ceiling in mid-January. Though with earnings season charging ahead, and another quarterly report from HAS due out before the open on Tuesday, April 27, middling HAS could be ready to make another big move.

Traders may want to consider the equity's history of dramatic post-earnings swings before delving into HAS before its quarterly report. During the company's last eight next-day sessions, Hasbro stock saw positive returns only two times, back in 2019, though one of these sessions ended in a 14.2% pop. On the other hand, Hasbro stock also suffered a 16.8% drop after its October 2019 report. This time around, the options pits are pricing in a 9.3% move for HAS, slightly larger than the 8.3% move the stock has averaged after its last eight reports, regardless of direction.

Despite this past volatility, option traders are still pricing in relatively low volatility expectations at the moment. This is per HAS' Schaeffer's Volatility Index (SVI) of 37%, which stands higher than only 27% of readings from the past 12 months. In other words, options are affordably priced right now.

Those that have already speculated on Hasbro stock's next move with options are leaning toward puts. In fact, at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), HAS sports a 10-day put/call volume ratio of 1.23, which stands in the 84th percentile of its annual range. This means long puts are outnumbering calls, and at a much quicker-than-usual pace.

Analysts have been a bit more optimistic. Of the 10 covering HAS, six say "strong buy" and four say "hold." What's more, the 12-month consensus price target of $107.86 is a 9.5% premium to current levels.