.jpg?sfvrsn=9ed9df06_4)

Wells Fargo stock just pulled back to a historically bullish trendline

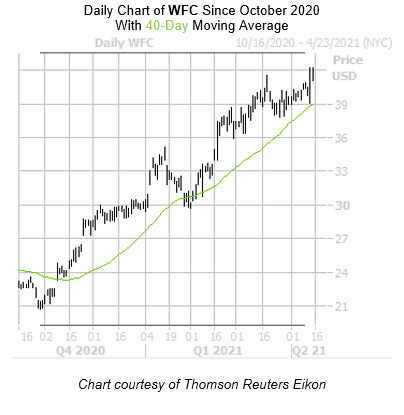

Wells Fargo & Co (NYSE:WFC) has already had a stellar 2021, though the shares were last seen marginally lower, down 0.4% to trade at $41.82 -- still near their highest level in over a year. Yesterday, the company reported first-quarter earnings and revenue that beat Wall Street's estimates, joining a growing number of bank stocks to do so and notching a slew of bull notes. The equity enjoyed a rare post-earnings surge, though it dipped to the $39 beforehand. That dip, however, also put the security near a historically bullish trendline that could send WFC even higher in the coming weeks.

Specifically, Wells Fargo stock just came within one standard deviation of its 40-day moving average, after spending considerable time above this trendline. According to data from Schaeffer's Senior Quantitative Analyst Rocky White, three similar signals have occurred in the past three years. For 67% the time, the security enjoyed a positive return one month later, averaging a 6.2% gain for that time period. From its current perch, a move of similar magnitude would put WFC over the $44 mark -- a level the stock has failed to see since March 2020.

Circling back to the analyst front, no less than 11 brokerages have chimed in with price-target hikes. The loftiest was dished out by Citigroup, who upped their price target to $50 from $37. Coming into today, the majority of analysts were bullish, though there's still plenty of room for additional upgrades as eight of the 18 in coverage sport a tepid "hold" rating.

Now could be a good time to weigh in on WFC's next move with options. The equity's Schaeffer's Volatility Index (SVI) of 28% sits at the lowest percentile of all other readings from the past year. This suggests options players are pricing in lower-than-usual volatility expectations at the moment.

Lastly, the security's Schaeffer's Volatility Scorecard (SVS) sits at a relatively high 72 out of 100, indicating the equity has exceeded volatility expectations during the past 12 months -- a boon for options buyers.