Emerson Electric reports earnings next month

Emerson Electric Co. (NYSE:EMR) is an American multinational technology and engineering company. The corporation manufactures products and provides engineering services and solutions for customers in the industrial, commercial, and consumer markets. Emerson Electric has approximately 83,500 employees and 200 manufacturing locations worldwide. This morning, EMR was last seen down 0.2% at $91.39

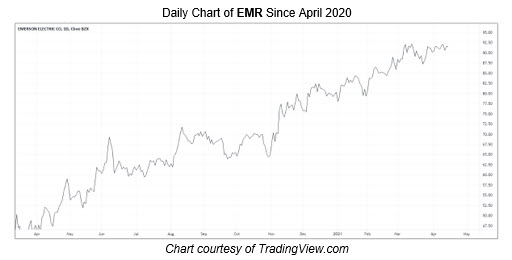

EMR has increased about 92% year-over-year and nearly doubled after bottoming at a multi-year low of $46.34. Shares of Emerson Electric stock have also increased 16% year-to-date. EMR is currently down just 2% from its record high of $93.38. Additionally, Emerson Electric has forward dividend of $2.02, which equates to a dividend yield of 2.21%.

Emerson Electric is scheduled to release its quarterly earnings before the open on Wednesday, May 5. Over the past year, EMR has outperformed analyst expectations on all four of its most recent earnings reports. For the first quarter of 2020, Emerson Electric beat analyst estimates by a margin of $0.15 and reported an earnings per share (EPS) of $0.89. For the second quarter of 2020, Emerson Electric dropped its EPS down to $0.80 but still beat expectations by a margin of $0.20. For the following quarter, EMR posted an increase in earnings, rising to $1.10 per share and beating estimates by a margin of $0.16. For the fourth quarter of 2020, Emerson Electric reported an EPS of $0.83 and beat expectations by a margin of $0.15.

Emerson Electric was able to maintain solid sales and net profits, making a quick recovery still a strong possibility for them. The company has already shown significant signs of growth in its most recent quarters. The key for Emerson Electric will be maintaining positive earnings performance, making the earnings report on Monday important for Emerson Electric stock’s short-term movement. Overall, EMR should be a steady grower in the long-term, from a fundamental perspective.

It should also be noted, however, that EMR trades at a relatively high price-earnings ratio of 26.40, so some short-term weakness could be a great buying opportunity for potential investors.

Regardless, analysts have been extremely optimistic on the equity. Heading into today, nine of the 14 in coverage sport a "strong buy" recommendation, with the remaining five posting a "hold."