A bullish signal is suggesting more record highs for Texas Instruments stock

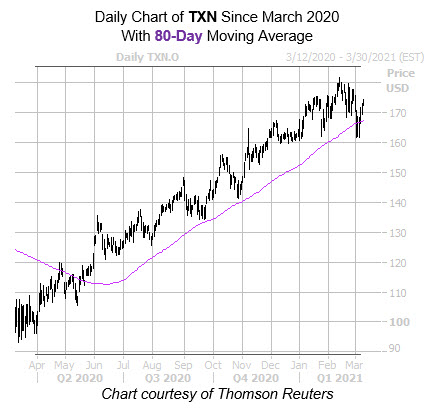

The shares of Texas Instruments Incorporated (NASDAQ:TXN) are higher today, last seen up 2.8% at $174.14. And while the equity has been cooling off from a Feb.16 all-time high of $181.80 over the past several weeks, it still sports a 63% year-over-year lead. Even better, this pullback has the semiconductor stock trading near a historically bullish trendline, indicating more record highs could be in store for TXN in the not-so-distant future.

Digging deeper, Texas Instruments stock just came within one standard deviation of its 80-day moving average, after spending significant time above this trendline. According to data from Schaeffer's Senior Quantitative Analyst Rocky White, at least six similar signals have occurred in the past three years. The security enjoyed a positive return one month later in 83% of those instances, averaging a 5.1% gain for that period. From its current perch, a move of similar magnitude would put TXN at a brand new record high of $183.02.

The brokerage bunch is still pessimistic towards Texas Instruments stock, leaving plenty of room for upgrades moving forward. Of the 22 analysts in coverage, 13 carried a tepid "hold" or worse rating. Meanwhile, the 12-month consensus target price of $182.15 is a 4.5% premium to current levels.

A shift in the options pits could keep the wind at the security's back. This is per TXN's 10-day put/call volume ratio of 1.98 at the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), which stands higher than 85% of readings in its annual range. Echoing this is the stock's Schaeffer's put/call open interest ratio (SOIR) of 1.44, which sits in 82nd percentile of the past 12 months. This means short-term traders have rarely been more put-biased.

Lastly, TXN options are quite cheap at the moment. The equity's Schaeffer's Volatility Index (SVI) of 31% sits higher than only 11% of all other readings from the past year. In other words, options players are pricing in lower-than-usual volatility expectations right now.