Northern Oil and Gas announced a price reduction in pending acquisition

Northern Oil and Gas, Inc. (NYSE:NOG) is an independent energy company engaged in the acquisition, exploration, development, and production of oil and natural gas properties. Its primary strategy is to invest in non-operated minority working and mineral interests in oil & gas properties. Northern Oil and Gas properties are primarily located in the premier basins within the United States.

On March 10, Northern Oil and Gas announced a price reduction for its pending acquisition of Marcellus Shale from Reliance Marcellus. The cash purchase price was reduced by $48.6 million to reflect approximately 2,200 net acres of excluded properties, or an approximate 3% reduction in acquired assets. Northern Oil and Gas' total purchase price went from $175 million to $126 million.

In the press release, Northern Oil and Gas highlighted its expectations for the acquired assets to produce $40-$45 million of cash flow from operations in 2021, versus its $55-$60 million prior estimate. As for its capital expenditures, that figure is now expected to range from $20-$25 million in 2021, versus its $25-$30 million prior estimate. Additionally, Northern Oil and Gas' CEO stated that he expects the change to have a minimal impact to the company’s free cash flow profile.

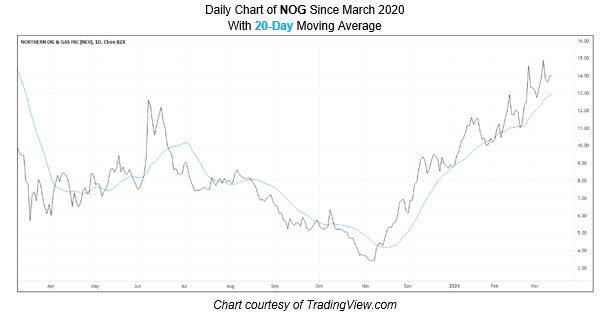

NOG stock has increased roughly 46% over the 12 months. At its record low back in November, the shares traded at $3.34. Since then, Northern Oil and Gas stock has more than tripled in price. Additionally, Northern Oil and Gas stock is up 60% year-to-date, with recent support stemming from the 20-day moving average. It's also worth noting that heading into today's trading, all nine covering analysts sport a "buy" or "strong buy" recommendation.

Another recent announcement is that Northern Oil and Gas will release its fourth-quarter earnings before the market opens on Friday, March 12. NOG has outperformed earnings expectations on two of its four most recent earnings reports.

Some key details about Northern Oil and Gas stock includes a forward price-earnings ratio of 8.83 and a price-book value ratio of 1.19. However, NOG carries a weak balance sheet with $984.53 million in debt and just $1.8 million in cash. Northern Oil and Gas has also seen a revenue decrease of more than $200 million and lost nearly $800 million in net income over the past twelve months. NOG's net losses now stand at $871.8 million.