LOCO will report earning on Thursday, March 11

El Pollo Loco Holdings, Inc. (NASDAQ: LOCO) is a Mexican-style restaurant chain. The chain has successfully opened and maintained more than 475 company-owned and franchised restaurants in Arizona, California, Nevada, Texas, Utah, and Louisiana.

On March 9, El Pollo Loco unveiled its new “restaurant of the future” design. LOCO has remodeled its first three restaurants to enhance off-premise convenience. In the company’s press release on the topic, El Pollo Loco stated that its “re-imagined restaurant designs are inspired by the changing habits of consumers to enjoy a more digital-forward and contactless experience that was inevitably sped up by the COVID-19 pandemic." El Pollo Loco is also expected to release its quarterly and full-year results after the close on Thursday, March 11.

LOCO has managed to beat earnings expectations on all four of its most recent earnings reports amidst a major sector-wide hit on restaurants during the COVID-19 pandemic shutdowns. For the fourth quarter of 2019, El Pollo Loco beat analyst estimates by a margin of $0.02 and reported an earnings per share (EPS) of $0.18. For the first quarter of 2020, LOCO decreased its EPS down to $0.16 yet still beat expectations by a margin of $0.06. For the second quarter of 2020, El Pollo Loco posted an increase in earnings, reporting an EPS of $0.20 and beating Wall Street estimates by a margin of $0.15. In its most recent quarterly report, LOCO reported an EPS of $0.28 and beat expectations by a margin of $0.06.

From a fundamental point of view, El Pollo Loco stock currently sits on the higher end of the spectrum for valuations. El Pollo Loco stock currently trades at a price-earning ratio of 30.56. Over the past twelve months, the company has generated $19 million in net profits, marking less than a $5 million decrease on the bottom line year-over-year. Overall, El Pollo Loco has done well in minimizing losses from the pandemic. LOCO's revenues are currently down about $18 million since fiscal 2019.

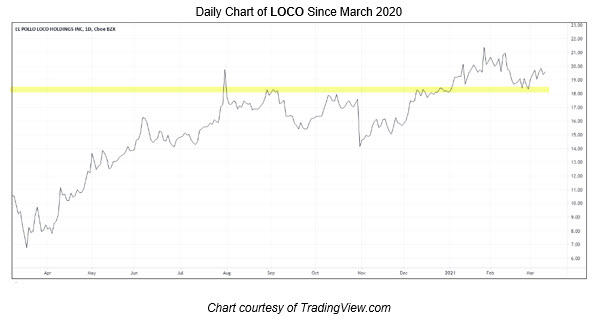

LOCO has increased 6% year-to-date, with longer-term support developed at the $18 level -- a former site of resistance for the shares. El Pollo Loco stock has also surged a whopping 106% year-over-year and is up 215% from its March 2020 record low of $6.15. In fact, the equity hit a five-year peak of $21.96 in late January.