The work-from-home stock is gearing up to wow investors with a strong report tomorrow

DocuSign, Inc. (NASDAQ:DOCU) is an American software company based out of San Francisco, California. The company’s main focus is to facilitate the process of electronic agreements with its e-signature technology. With a market cap of $39.9 billion, DocuSign is undoubtedly one of -- if not the -- biggest e-signature company on the market. Although Adobe Sign and HelloSign compete in the same space, both are subsidiaries of bigger companies Adobe (ADBE) and Dropbox (DBX). This has allowed DocuSign to take the majority of the market share in the world of e-signature technology.

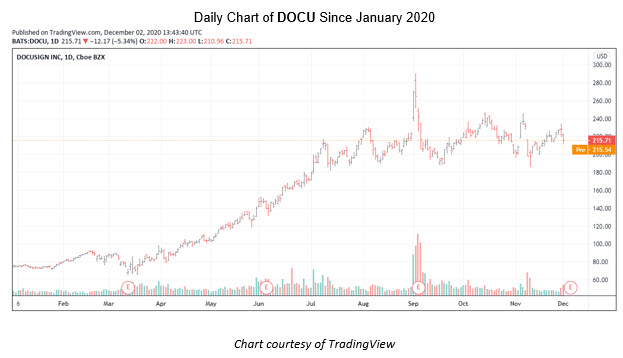

DOCU just went public in 2018 and DocuSign stock has since grown over 600%, with the majority of its growth occurring in 2020. DocuSign stock is up a massive 191% year-to-date, clearly benefiting from the significant increase in people working from home due to the Covid-19 pandemic. DocuSign stock has also grown 232% since tapping its 52-week low of $64.88. DocuSign stock is down 26% from its 52-week high of $290.23.

DOCU is gearing up to report quarterly earnings tomorrow, where the company will look to push DocuSign stock back up near its recent highs. DOCU has beat expectations on all four of its most recent earnings reports. In the company's fiscal fourth quarter of 2019, DocuSign beat earnings expectations by $0.08. The company reported an earnings per share (EPS) of $0.11. In the first quarter of 2020 for the company, DocuSign increased its EPS to $0.12, beating expectations by a margin of $0.07. The company maintained its $0.12 EPS when reporting for its second quarter earnings of 2020, beating expectations by a margin of $0.02. In its most recent quarter, DOCU beat its earnings target by $0.09 (112.5%) for the third fiscal quarter of 2020. The company reported an EPS of $0.17 instead of the expected EPS of $0.08. For its tomorrow's earnings report on DocuSign's fiscal fourth quarter of 2020, the company is expected to report an EPS of $0.13.

DocuSign has shown incredible growth over the past few years, especially in 2020. The company has more than doubled its revenue since its IPO in 2018, and has nearly tripled revenue since 2017. DocuSign has also improved greatly on its balance sheet over the past couple years when compared to the -$347 million of equity the company had in 2017. DocuSign now holds nearly as much cash as it has in debt marking an incredible turnaround in just three years.

From a fundamentals perspective, DocuSign's biggest downside for investors has been its inconsistent net income growth. Although it is normal for growth companies to experience years of net losses, investors will be eager to see some improvement on the company's bottom line in tomorrow's report. The future should be bright for DocuSign stock, as long as DOCU can keep growing near its current rate.