SPWR recently grabbed a five-year high

SunPower Corporation (NASDAQ:SPWR) has so far enjoyed a strong November, as renewable energy stocks enter the spotlight thanks to President-elect Joe Biden. Furthermore, data from Schaeffer's Senior Quantitative Analyst Rocky White suggests the stock could see more tailwinds ahead.

SunPower stock scored a five-year high of $21.60 on Nov. 9. What's more, this peak comes amid historically low implied volatility (IV), which has been a bullish combination for SPWR in the past. More specifically, there were two other instances when the stock was trading within 2% of its 52-week high, while its Schaeffer's Volatility Index (SVI) sat in the 20th percentile of its annual range or lower -- as is the case with the stock's current SVI of 84%, which ranks in the 12th percentile of its 12-month range.

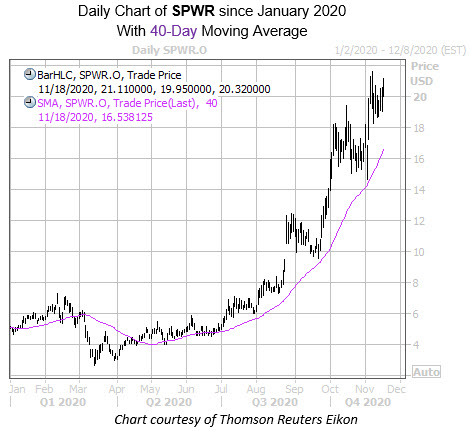

One month after these signals, the equity averaged a return of 26.5%. From its current perch at $20.32, a move of similar magnitude would put the stock around $25.70, territory not seen since June of 2014. SPWR has had an impressive run since its March 16 low of $2.63, with pullbacks contained by its 40-day moving average.

A short squeeze could act as a catalyst as well. Short interest fell by 8.4% during the most recent reporting period, however, the 38.24 million shares sold short still account for 47.2% of the stock's available float. In other words, it would take nearly five days to buy back these bearish bets, at SunPower stock's average pace of trading.

There is still a surprising amount of room for upgrades as well, seeing as nine of the 11 analysts in coverage sport a "hold" or worse rating on the security. Meanwhile, SPWR's 12-month consensus price target of $16.24 is a 20.1% discount to current trading levels, which could mean bull notes are overdue in the form of price-target hikes.