It was the Nasdaq's longest losing streak since the presidential election

Stocks suffered their worst session of 2019 on Monday, as traders dumped equities for "safe havens" like gold amid the escalating trade war between the U.S. and China. What's more, it marked the sixth straight loss for the S&P 500 Index (SPX) and tech-heavy Nasdaq Composite (IXIC) -- their longest losing streaks since October 2018 and November 2016, respectively. Below, we take a look at what previous losing streaks have meant for the SPX and Nasdaq going forward.

After the last S&P six-day losing run in late October, the index rallied 10.8% over the subsequent six months. Likewise, following the pre-election sell-off in the Nasdaq back in early November 2016, the index went on to rebound an impressive 17.9% over the next six months, per data from Schaeffer's Senior Quantitative Analyst Rocky White. In fact, the last time the SPX was lower six months after a six-day losing streak was after the June 2011 downturn, and the last time the IXIC was in the red six months out was after the mid-financial crisis losing streak of October 2008.

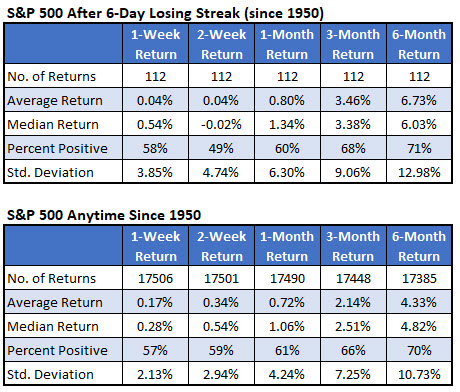

On average, the SPX has recovered 6.73% in the six months after six-day losing streaks, looking at data since 1950. Further, the index was in the black at that checkpoint 71% of the time. That's better than the index's average anytime six-month gain of 4.33%, with a win rate of 70%.

In the same vein, the Nasdaq has averaged a six-month gain of 6.21% after six-day losing streaks, looking back to 1971. That's slightly better than its average anytime six-month return of 5.87%. However, the anytime win rate of 69% is stronger than the post-losing streak win rate of 62%.

Digging deeper, while the SPX's post-streak returns are better than usual three months out -- it was up nearly 3.5% after a streak, on average, compared to 2.14% anytime -- the Nasdaq's near-term returns after losing streaks leave much to be desired. The IXIC was up less than 1%, on average, three months after a six-day decline, compared to its average anytime gain of 2.89%.

In the even shorter term, both indexes could underperform, if past is prologue. One and two weeks after six-day losing streaks, the S&P 500 averaged a gain of just 0.04%, compared to average anytime returns of 0.17% and 0.34%, respectively. The Nasdaq, meanwhile, averaged one- and two-week losses after six-day losing streaks, compared to average anytime gains of 0.22% and 0.44%, respectively.

There is one consistency across the board, though: volatility tends to run hotter than usual after losing streaks. As you can see on the charts below, Standard Deviation is higher than normal after the SPX and IXIC suffer six straight losses.

In conclusion, both the S&P 500 Index and Nasdaq tend to underperform immediately after a six-day losing streak, so it wouldn't be outside the norm to see stocks continue to struggle over the next couple of weeks. Over the intermediate-to-long term, though, both indexes have bounced back in a big way in the six months after streaks, so history also favors a rally back to record highs in early 2020. In the meantime, however, traders may want to brace for more volatility than usual.