The shares have gained more than 11% so far this month

It's been a dismal month for the U.S. stock market, with the S&P 500 Index (SPX) pacing toward a 6.5% May decline. However, video game stock Take-Two Interactive Software, Inc. (NASDAQ:TTWO) has been a bright spot amid the broader battering, up 11% from its April 30 close, and headed for its third straight monthly gain.

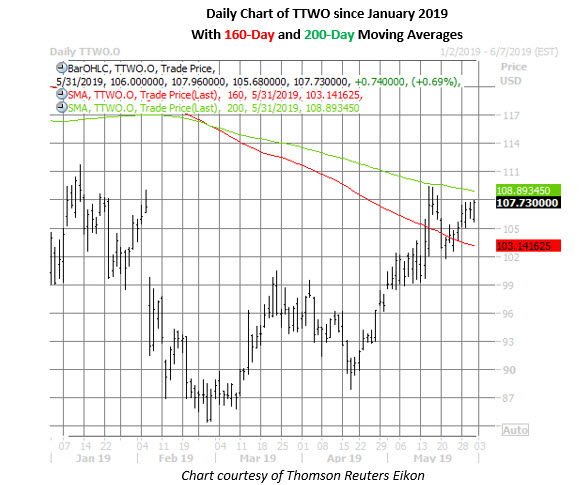

In fact, the shares have closed lower just five times during the month of May, last seen trading up 0.7% at $107.73. Plus, a positive earnings reaction mid-month helped TTWO reclaim a foothold atop the century mark and its 160-day moving average, both of which were successfully tested as support during a brief consolidation of these post-earnings gains. The equity is now staring up at its 200-day moving average, which hasn't been toppled on a daily closing basis since Nov. 8.

Options traders have been unusually bearish toward the outperforming stock, which sparks our interest as contrarian traders. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), the equity's 10-day put/call volume ratio of 1.33 ranks in the 93rd annual percentile, meaning puts have been bought to open over calls at an accelerated clip.

Likewise, TTWO's Schaeffer's put/call open interest ratio (SOIR) of 1.02 registers in the 92nd percentile of its 12-month range, indicating short-term speculators are more put-heavy than usual toward the stock. This could create tailwinds for Take-Two Interactive, as the hedges related to these bets are unwound.

Those wanting to bet on Take-Two Interactive Software's short-term trajectory may want to consider a premium-buying strategy. The stock's Schaeffer's Volatility Index (SVI) Of 34% arrives in the 12th annual percentile, meaning near-term options are pricing in low volatility expectations at the moment -- a key to maximizing the benefit of leverage.