Urban Outfitters stock just ran into a historically bearish trendline

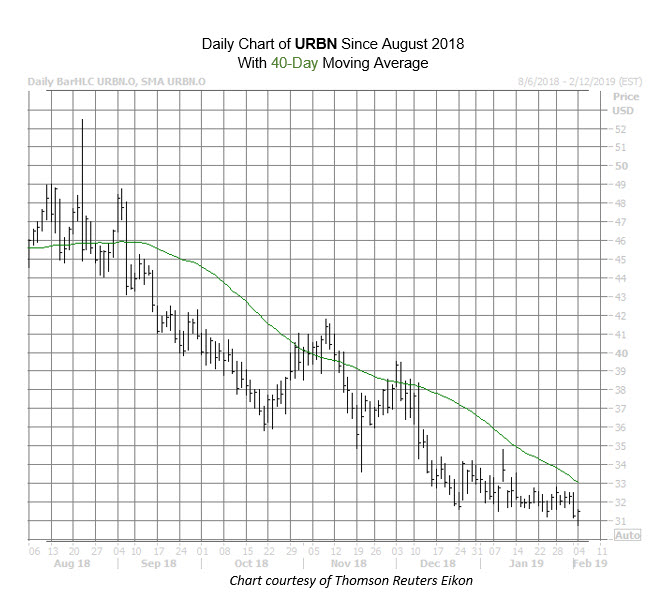

The shares of Urban Outfitters, Inc. (NASDAQ:URBN) have been trading in a channel of lower highs and lows since their August peak of $52.50, recently hitting an annual low of $31.15 on Friday, Feb. 1. Today, the retail stock is trading slightly higher, up 0.9% at $31.53, but just flashed a historically bearish signal, suggesting URBN's next leg lower could be just around the corner.

Specifically, the security just came within one standard deviation of its 40-day moving average after a lengthy stretch below the trendline. According to data from Schaeffer's Senior Quantitative Analyst Rocky White, this signal has flashed 10 other times in the past three years, with URBN stock lower one month later 78% of the time. After these signals, the stock averaged a one-month loss of 6.2%. From where it currently sits, a similar move could put the equity just south of $30 -- an area not charted since November 2017.

Bears have already started piling on the struggling stock. Short interest grew nearly 52% in the past reporting period, and the 13.04 shares currently sold short represent a healthy 16.04% of the stock's available float.

Analysts are also starting to sour on the retailer, but there's plenty of room on the bearish bandwagon. URBN currently sports 13 tepid "hold" ratings, though five still give it a "buy" or better rating, with not a "sell" to be seen. Plus, the consensus 12-month target price of $42.06 represents a 33.7% premium to current levels, and sits in an area not explored since September. Should the stock continue its southern trajectory, a round of analyst downgrades and price-target cuts could create even stiffer headwinds.