Ford Motor will report earnings after the close tomorrow

Earnings season is hitting high gear, and one of the first auto names due up is Ford Motor Company (NYSE:F), scheduled to report fourth-quarter earnings after the close tomorrow, Jan. 23. F stock has been more volatile than usual lately, per its 30-day historical volatility of 45.7% -- in the 95th annual percentile -- and the options market is expecting more of the same for Thursday's session.

Specifically, Trade-Alert places the implied earnings deviation for Ford at 5.9% -- more than the 3.9% next-day move the stock has averaged over the last two years. During this eight-quarter span, the stock has closed negative in the subsequent session five times, and only two post-earnings moves have been large enough to match or exceed what the options market is pricing in this time around (a 9.9% gain in October, and a 6% fall last July).

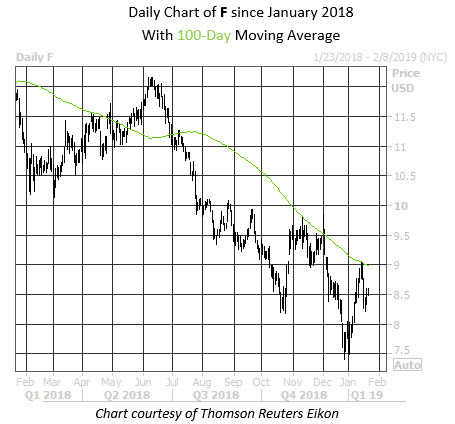

On the charts, F rallied off its post-Christmas low of $7.42, but last week was turned away by its 100-day moving average. Historical headwinds could complicate things in the short term, considering Ford stock, which has shed 28% year-over-year, is one of the worst stocks to own in the week following Martin Luther King Jr. Day.

On the sentiment front, most analysts are cautious on the car stock, with eight of 12 in coverage rating it a "hold." Plus, short sellers have been upping the ante lately, with short interest up 11% in the last two reporting periods. The 106.3 million shares sold short represents a slim 2.7% of the security's total available float, though.

Options traders have been raising the bearish stakes, too. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), F's 10-day put/call volume ratio of 1.09 ranks in the 92nd annual percentile, meaning puts have been bought to open at an accelerated pace.