Both names will report earnings next week

It's been a rough stretch for mining stocks, as evidenced by 4.6% month-to-date deficit for the SPDR S&P Metals & Mining ETF (XME). This pullback may have potentially created buying opportunities throughout the sector, though, with Cleveland-Cliffs Inc (NYSE:CLF) and Steel Dynamics, Inc. (NASDAQ:STLD) in particular trading near trendlines that have marked attractive entry points in the past.

Short Sellers Blast Outperforming Cleveland-Cliffs Stock

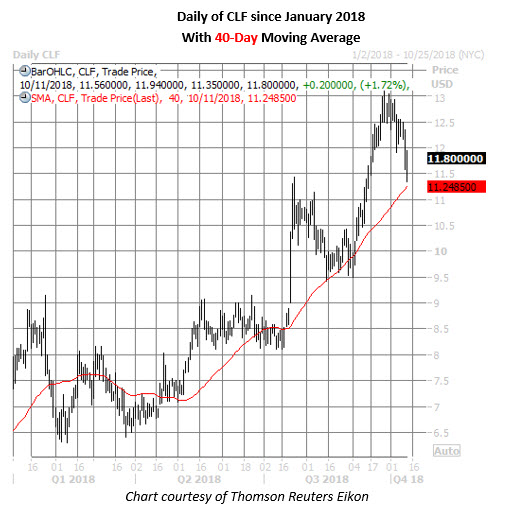

After topping out at a four-year high of $13.10 on Sept. 26, Cleveland-Cliffs pulled back to within one standard deviation of its rising 40-day moving average. There have been seven other times since 2015 CLF has come this close to its 40-day trendline after trading above it 60% of the time in the last two months and in eight of the past 10 sessions. According to data from Schaeffer's Senior Quantitative Analyst Rocky White, the stock went on to average a one-month gain of 5.77% after these previous occurrences.

Today, CLF stock is up 1.7% at $11.80, finding support earlier in the $11.40-$11.50 region, home to its late-July highs. The shares are boasting a 73.9% year-over-year advance, and a round of short covering could fuel a bigger bounce.

Short interest on CLF surged 13.7% in the two most recent reporting periods to 43.96 million shares, representing 14.9% of the equity's available float, or almost four times the average daily pace of trading.

STLD Stock Trades Above Key Technical Support

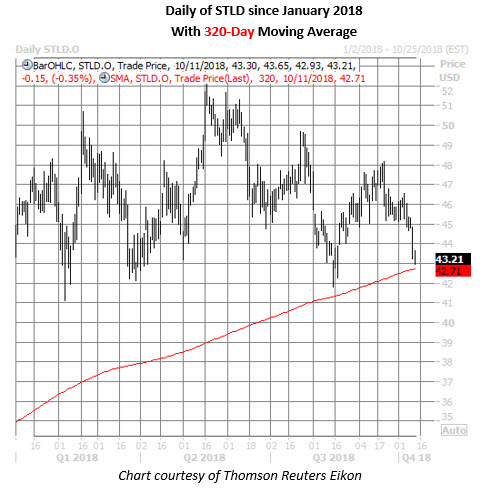

Steel Dynamics has shed 4.6% so far in October, but the stock is now trading within one standard deviation of its 320-day moving average. In the two other times this has happened after the shares had spent a lengthy stretch above this trendline, they were up 9.12%, on average, one month later, with both of those returns positive.

In today's trading, STLD has explored both sides of breakeven, last seen down 0.4% at $43.21. The equity earlier staged another successful test of its year-to-date breakeven level of $43.11, which has served as staunch support for the shares in 2018.

Should history repeat itself, a capitulation from some of the weaker bearish hands could strengthen tailwinds for STLD. It would take short sellers almost one week to cover the 7.42 million Steel Dynamic shares that are sold short, at the equity's average daily pace of trading.

Cleveland-Cliffs, Steel Dynamics Earnings Ahead

Looking ahead, both companies are slated to report third-quarter earnings next week, with Cleveland-Cliffs' results due out before the market opens next Friday, Oct. 19, and Steel Dynamics scheduled to unveil its numbers after the close next Wednesday, Oct. 17. CLF has closed higher in the session following the company's last two quarterly reports, averaging a 10.05% gain, while STLD's post-earnings price action has been more mixed -- adding 2.8% in July, and falling 0.3% last April.