The shares hit a record high earlier today

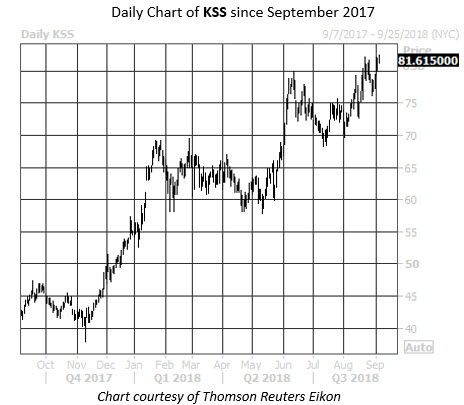

Retail stock Kohl's Corporation (NYSE:KSS) has a been steady climber this summer, adding nearly 10% since this buy signal flashed back in mid-August. After nabbing a record high of $82.40 earlier today though, this signal is flashing again -- suggesting KSS shares could be headed even higher.

Specifically, the stock's Schaeffer's Volatility Index (SVI) of 34% ranks in the 11th percentile of its annual range. This indicates short-term options are cheap, from a volatility perspective.

What's more, per data from Schaeffer's Senior Quantitative Analyst Rocky White, the three other times KSS has been trading within 2% of a new 52-week high while front-month volatilities have been this low resulted in an average one-month gain of 14.8%. Plus, all three of those returns were positive.

The optimism is certainly building on the the retailer, which is just two weeks removed from second-quarter earnings and revenue beats. And earlier this week, Goldman Sachs waxed optimistic on department stores and off-price retailers, initiating coverage on Kohl's stock with a "buy" rating and $91 price target.

Overall, KSS sports a 50% lead in 2018, and has now nearly doubled in the past 12 months. There is ample room for more analysts to revise their ratings, considering 11 of 18 brokerages maintain a "hold" or "strong sell" recommendation. Plus, the average 12-month price target of $82.06 sits right near current trading levels. A flurry of upgrades and/or price-target hikes could also create tailwinds for the stock.

Short sellers have been heading for the exits since mid-June, and a continued surge could squeeze the remaining bearish bettors. The 25.63 million shares sold short represents almost 16% of the total available float, and at the security's average daily trading volume, it would take almost nine days to buy back those short positions.