Amazon will report earnings after tomorrow's close

Online retail powerhouse Amazon.com, Inc. (NASDAQ:AMZN) is up 0.2% at $1,832.26, as the stock market prepares for more highly anticipated FAANG earnings. Amazon is slated to report second-quarter earnings after the close on Thursday, July 26, and below we will take a look at how the e-tailer has been faring on the charts ahead of the release.

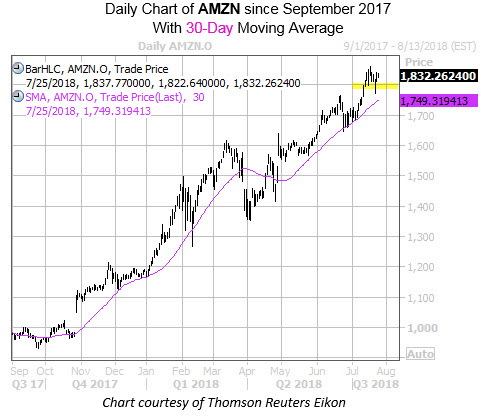

Amazon has put in an impressive performance since its September lows, and has gained 57% year-to-date. The stock has benefited from support atop its rising 30-day moving average since March, and topped out at a record high of $1,858.88 on July 18. AMZN stock pulled back briefly earlier this week following a scathing tweet from President Donald Trump, but has found a foothold atop the $1,800 mark -- home to its July 12 bull gap highs.

Digging into its earnings history, AMZN stock has closed higher the day after five of the company's last eight earnings reports, including a 13.2% swing higher last October. On average, the shares have moved 4% in the post-earnings session over this two-year time frame, regardless of direction. This time around, the options market is pricing in a larger-than-usual 7.2% next-day move for Friday's trading.

Unsurprisingly, analyst attention has been overwhelmingly optimistic toward Amazon stock. This is evidenced by the 30 of 32 covering firms sporting "buy" or "strong buy" ratings. However, AMZN's average 12-month price target sits at $1,914.38 -- a slim 5% premium to current levels, suggesting another post-earnings move higher could spark some upwardly revised Amazon price targets.

Looking toward options data, Amazon stock's short-term traders are more put-skewed than usual, with its Schaeffer's put/call open interest ratio (SOIR) of 1.22 ranking in the 100th percentile of its annual range. This indicates that near-term put open interest outweighs call open interest by a wider-than-usual margin right now.

Lastly, AMZN's Schaeffer's Volatility Scorecard (SVS) comes in at an 89 out of a possible 100. This indicates that the stock has tended to outsized moves relative to what the options market has priced in over the past year. This could be a boon to those buying premium on the FAANG stock.