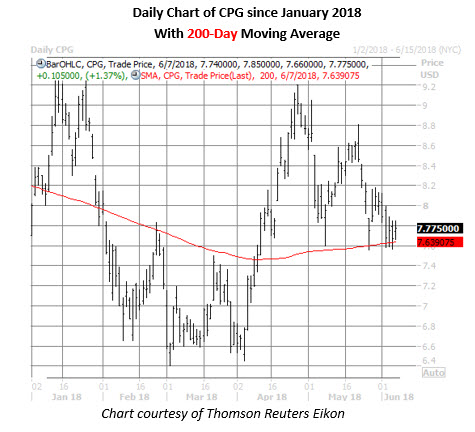

The shares are trading near their 200-day moving average

Oil prices bounced back today as global oversupply concerns eased. July-dated crude futures rose 1.9% to settle at $65.95 per barrel, but remain well off their three-year highs from late May. This price action has been tracked in the broader energy sector, and may have created attractive entry points for several oil stocks. One name in particular is Canada-based light oil producer Crescent Point Energy Corp (NYSE:CPG), which recently pulled back to a trendline with historically bullish implications.

Looking closer, CPG stock hit an intraday peak of $8.81 on May 22 before pulling back to familiar support at its 200-day moving average. Per data from Schaeffer's Senior Quantitative Analyst Rocky White, the last two other times the security has come within one standard deviation of this trendline after a lengthy stay above it, it's gone on to average a one-month gain of 4.78%. Based on its current perch at $7.77 -- up 1.2% on the day -- another move of this magnitude would put Crescent Point Energy back near $8.16.

On the sentiment front, the oil stock has been a popular target among options traders, relatively speaking, and it looks like the bulk of them are targeting even longer-term upside, too. Currently, there are 13,195 calls and 2,175 puts outstanding on CPG stock -- a 12-month peak in total open interest.

Plus, eight of the equity's 10 top open interest positions are calls, with the October 7.50 call in the lead. This call strike is also most popular in the front-month series, and data from Trade-Alert points to buy-to-open activity at both options.

There's significant optimism being priced in outside of the options pits, too, with four of six analysts maintaining a "buy" rating, and not a single "sell" to be found. Plus, short sellers recently covered a number of bets, with short interest down 30% in the most recent reporting period.