Plus, a look at the record decline in silver exposure

Some say the rabid rise of bitcoin -- and the newly available bitcoin futures -- has dulled demand for gold. However, gold isn't alone in its recent struggles, with the iShares Silver Trust (SLV) down nearly 8% in the past month, and large speculators abandoning silver at a record-high pace. Below, we'll take a look at the huge silver liquidations -- and what traders might expect for SLV after today's Fed meeting.

Large Speculators Abandon Silver

Per the latest Commitment of Traders (CoT) data, large speculators reduced their net long exposure on silver by nearly 28,000 contracts last week -- the biggest decline ever recorded. There have been just seven weekly declines of more than 20,000 positions ever, according to Schaeffer's Quantitative Analyst Chris Prybal. The two-week drop of 36,150 contracts is the second-largest ever, exceeded only by a signal in May 2017.

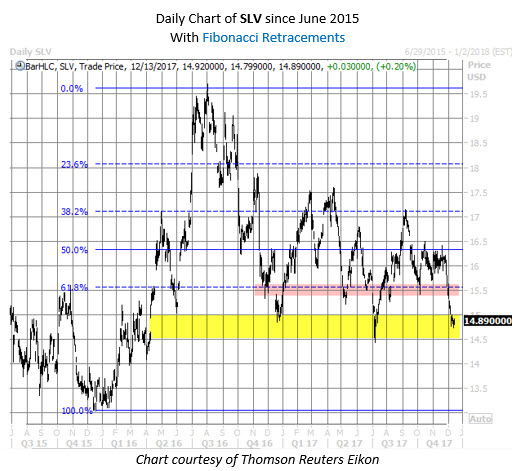

The shares of SLV are now trading near their July lows, having recently breached support around $15.50 -- a 61.8% Fibonacci retracement of the fund's rally from its 2015 lows to its 2016 highs. However, the $14.50-$15 neighborhood has contained pullbacks since mid-2016. At last check, oversold SLV was up 0.2% at $14.89.

When to Buy SLV After a Rate Hike

If past is prologue, the silver ETF could be in for even rougher waters in the near term, should the Fed hike rates as expected today. The central bank has lifted interest rates four times since 2015, and the SLV ETF has averaged near-term losses afterwards. Specifically, SLV was down an average of 1.38% a week after rate hikes, and down 0.14% one month later, per Schaeffer's Senior Quantitative Analyst Rocky White. That's compared to average anytime gains since 2015.

However, two and three months after a rate hike, SLV has outperformed, averaging gains of 2.83% and 3.10%, respectively. Further, the fund was higher three out of four times at these markers. That's compared to SLV's average anytime two - and three-month gains of 0.47% and 0.54%, respectively, with a win rate that doesn't exceed 50%.

So, while the sample size is small, history suggests SLV could extend its retreat into 2018, but speculators may want to jump in around mid-January, which could be the "silver sweet spot." (Here are more stocks to avoid after a rate hike, as well as the best stocks to buy.)