The SPX has historically experienced short-term struggles in the wake of a Fed interest-rate hike

The Federal Open Market Committee (FOMC) will

release its latest policy statement at 2 p.m. ET today, and while expectations are low that the central bank will announce an interest rate hike this afternoon, traders will be looking for hints on a possible September rate hike -- the first the market will have seen since June 2006.

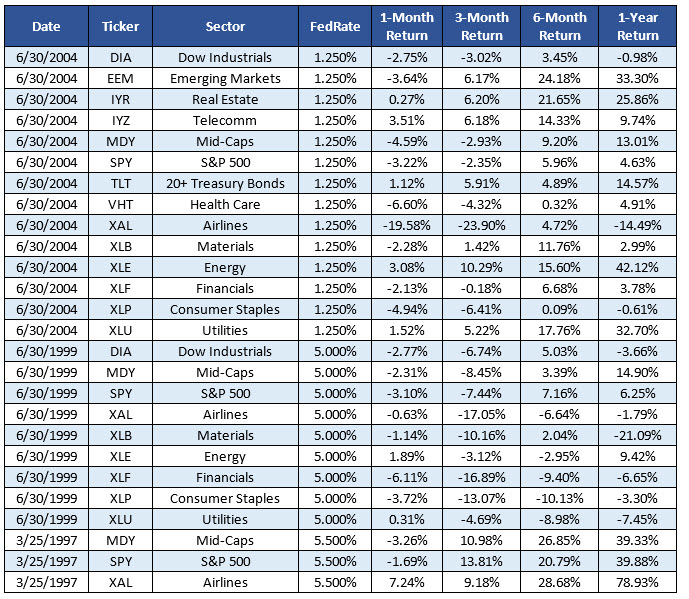

Over the past 40 years, Schaeffer's Senior Quantitative Analyst Rocky White found 10 occurrences where the Fed raised interest rates for the first time in at least a year -- and broke down the numbers to see how the

S&P 500 Index (SPX) historically reacted in the wake of these decisions.

Looking at the charts below, it appears the SPX experiences short-term struggles in the wake of the interest rate hikes. Specifically, the benchmark averages a one-month loss of 1.4%, and is positive just 30% of the time. Going out one year, however, it appears the market tends to stabilize, as the SPX averages a 12-month gain of 10.8%, and is positive 80% of the time.

Here's another perspective. It plots the price action of the S&P 500 Index along with the federal funds target rate since 1975.

Drilling down on specific sectors, energy turned in outperformance in both the short-and long-term following the 1999 and 2004 rate hikes -- with the Energy Select Sector SPDR ETF (XLE) notching one-month gains of 1.9% and 3.1%, respectively. These widened to a respective 9.4% and 42.1% when going out one year.

On the flip side, financials saw a short-term drop following interest-rate adjustments in 1999 and 2004, with the Financial Select Sector SPDR ETF (XLF) shedding 6.1% and 2.1%, respectively, in the ensuing one-month period. Going out one year, this price action diverges, with the XLF surrendering 6.7% in 1999, and adding 3.8% in 2004.